Professional Documents

Culture Documents

ACC 3501-Fair Value Adj

Uploaded by

atikah0 ratings0% found this document useful (0 votes)

22 views7 pagesACC 3501-Fair Value Adj

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACC 3501-Fair Value Adj

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views7 pagesACC 3501-Fair Value Adj

Uploaded by

atikahACC 3501-Fair Value Adj

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 7

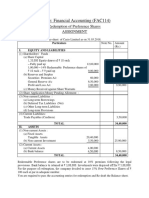

ACC 3501: Advanced Group

Accounting

Fair value adjustments and recognition of

unrecognized assets in the subsidiary

NAMG Sem 1 2017/18 1

Fair value adjustments of assets in the

subsidiary

Purchase price = Net identifiable assets taken over (fair values) +

goodwill

Example

P acquired 90% of the ordinary shares in S on 1.1. X9. In determining

the purchase price for the shares in S, the assets in S were valued by P

on 1.1.X9 as follows:

Fair value Book value(S)

Plant & Machinery $450,000 $400,000

Fixtures & fittings $180,000 $190,000

Brand $ 20,000 Nil

No adjustment has been made in the books of S to reflect the fair

values. P & M are depreciated at 10% based on the book value and

fittings at 5% on the book value. The groups policy is not to depreciate

brand.

NAMG Sem 1 2017/18 2

Fair value adjustmentscontd

(1) To reflect the fair values (Compare the fair value on the date of

acquisition to the book value on the date of acquisition)

Fair value Book value (S) Difference

Plant & Machinery $450,000 $400,000 $50,000

Fixtures & fittings $180,000 $190,000 $10,000

Brand $ 20,000 Nil $20,000

(a) Dr P & M (S) 50,000

Brand (CSFP) 20,000

Cr F & F (S) 10,000

Cr Asset Revaluation Reserve 60,000

NAMG Sem 1 2017/18 3

Fair value adjustmentscontd

(b) On consolidation,

Dr Asset Revaluation Reserve 60,000

Cr COC (90%) 54,000

Cr NCI (10%) 6,000

Same treatment as any other pre-acquisition

reserves in the subsidiary

NAMG Sem 1 2017/18 4

Fair value adjustments contd

(2) Adjustment for depreciation (Compare the

amount of depreciation provided by S (BV) to

the amount that should be provided from

the groups point of view (FV)

NAMG Sem 1 2017/18 5

Fair value adjustmentscontd

In S (BV)

Depreciation charge for the year X9;

P&M: 10% x 400,000 = 40,000

F&F: 5% x 190,000 = 9,500

49,500

From the groups point view (FV),

P&M:10% x 450,000 = 45,000

F&F : 5% x 180,000 = 9,000

54,000

Under-provision of depreciation by S of 4,500

NAMG Sem 1 2017/18 6

Fair value adjustmentscontd

To increase the depreciation charge for the year

from 49,500 to 54,000;

Dr P&L (S) 4,500

Dr Acc depreciation F&F (S) 500

Cr Acc depreciation P&M (S)5,000

NAMG Sem 1 2017/18 7

You might also like

- Chapter12 - AnswerDocument26 pagesChapter12 - AnswerAubreyNo ratings yet

- Chapter12 - Answer PDFDocument25 pagesChapter12 - Answer PDFAvon Jade RamosNo ratings yet

- Chapter12 - Answer PDFDocument25 pagesChapter12 - Answer PDFJONAS VINCENT SamsonNo ratings yet

- Chapter12 - Answer PDFDocument25 pagesChapter12 - Answer PDFAvon Jade RamosNo ratings yet

- Intercompany TransactionsDocument7 pagesIntercompany TransactionsJulie Mae Caling MalitNo ratings yet

- Chapter12 - AnswerDocument26 pagesChapter12 - AnswerGraceNo ratings yet

- Comprehensive Exam Part 1 QuestionnaireDocument9 pagesComprehensive Exam Part 1 QuestionnaireMac b IBANEZNo ratings yet

- Gross Profit Variation AnalysisDocument9 pagesGross Profit Variation AnalysisronnelNo ratings yet

- MAS B41 First Pre-Board Exams (Questions, Answers - Solutions)Document15 pagesMAS B41 First Pre-Board Exams (Questions, Answers - Solutions)Nanananana100% (3)

- Nfjpiancr Ncrcup6 AFAR EliminationRound QuestionsDocument19 pagesNfjpiancr Ncrcup6 AFAR EliminationRound QuestionsIvan DorosanNo ratings yet

- MASDocument19 pagesMASKelly CardejonNo ratings yet

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- Manila MAY 5, 2022 Preweek Material: Management Advisory ServicesDocument25 pagesManila MAY 5, 2022 Preweek Material: Management Advisory ServicesJoris YapNo ratings yet

- Mas Cup 21 - QuestionsDocument4 pagesMas Cup 21 - QuestionsPhilip CastroNo ratings yet

- Quiz On Intercompany Profits Quiz 3 THEORY-The First Four Numbers Should Be Answered Using The FollowingDocument9 pagesQuiz On Intercompany Profits Quiz 3 THEORY-The First Four Numbers Should Be Answered Using The FollowingAgatha de CastroNo ratings yet

- Financial Statement Consolidation1 4Document4 pagesFinancial Statement Consolidation1 4crookshanksNo ratings yet

- Quiz Conso FSDocument3 pagesQuiz Conso FSMark Joshua SalongaNo ratings yet

- AFARDocument9 pagesAFARRed Christian PalustreNo ratings yet

- Mock Reviewer in Management AccountingDocument6 pagesMock Reviewer in Management AccountingJA VicenteNo ratings yet

- FS Analysis Ans KeyDocument5 pagesFS Analysis Ans KeyTeofel John Alvizo PantaleonNo ratings yet

- MS-1stPB 10.22Document12 pagesMS-1stPB 10.22Harold Dan Acebedo0% (1)

- Accounting FundamentalsDocument16 pagesAccounting FundamentalsRyan Christian M. CoralNo ratings yet

- Docxnamhsygdtref 534 RewdsfacxzDocument8 pagesDocxnamhsygdtref 534 Rewdsfacxzkamau samuelNo ratings yet

- Acctg 10Document5 pagesAcctg 10baek hyun canawayNo ratings yet

- Investment PropertyDocument14 pagesInvestment PropertyJomerNo ratings yet

- IntercompanyDocument8 pagesIntercompanyYan FranciaNo ratings yet

- 1 - Strategic Thinking, Profit Planning and CVP Analysis KeyDocument4 pages1 - Strategic Thinking, Profit Planning and CVP Analysis KeyEdward Glenn BaguiNo ratings yet

- MASDocument9 pagesMASJulius Lester AbieraNo ratings yet

- This Study Resource Was: Page 1 of 5Document5 pagesThis Study Resource Was: Page 1 of 5Baobel PremiumsNo ratings yet

- College of Business Administration and Accountancy Management Advisory Services I Pre-Final ExamDocument3 pagesCollege of Business Administration and Accountancy Management Advisory Services I Pre-Final ExamVel JuneNo ratings yet

- Pamantasan ng Cabuyao Cost-Volume-Profit Analysis Long QuizDocument10 pagesPamantasan ng Cabuyao Cost-Volume-Profit Analysis Long QuiztanginamotalagaNo ratings yet

- CCDocument28 pagesCCeiNo ratings yet

- Cau hoi varianceDocument9 pagesCau hoi variancePhạm Mình CongNo ratings yet

- Practice Questions: Global Certified Management AccountantDocument23 pagesPractice Questions: Global Certified Management AccountantThiha WinNo ratings yet

- Solutions For CH 9 2-26-14Document15 pagesSolutions For CH 9 2-26-14Rafael Ricardo VilleroNo ratings yet

- Level 2 DifficultDocument4 pagesLevel 2 DifficultSamuel FerolinoNo ratings yet

- AFAR TestbankDocument56 pagesAFAR TestbankDrama SubsNo ratings yet

- LEVEL 2 Online Quiz - Questions SET ADocument8 pagesLEVEL 2 Online Quiz - Questions SET AVincent Larrie MoldezNo ratings yet

- Quiz Ins Sales Oct5Document6 pagesQuiz Ins Sales Oct5AlexNo ratings yet

- Inventory, Costs, and Revenue Calculations for Sobrangbagal CompanyDocument10 pagesInventory, Costs, and Revenue Calculations for Sobrangbagal CompanyrochielanciolaNo ratings yet

- ABC Institute of Commerce Partnership AdjustmentDocument6 pagesABC Institute of Commerce Partnership AdjustmentManav KhandelwalNo ratings yet

- Quiz On MSDocument8 pagesQuiz On MSEunize EscalonaNo ratings yet

- ITEMS 41 To 46 - AnswersDocument4 pagesITEMS 41 To 46 - AnswersAngel Joy HelicameNo ratings yet

- College of The Immaculate ConceptionDocument6 pagesCollege of The Immaculate ConceptionDexter Saguyod ApolonioNo ratings yet

- P2Document7 pagesP2chowchow123No ratings yet

- Masquerade (Regional Eliminations)Document5 pagesMasquerade (Regional Eliminations)Ayvee BlanchNo ratings yet

- Cpar AfarDocument21 pagesCpar AfarFrancheska NadurataNo ratings yet

- Intercompany Sales - Inventories ProblemsDocument13 pagesIntercompany Sales - Inventories ProblemsMhelka Tiodianco100% (2)

- A6 Audit of Ppe Part 2Document5 pagesA6 Audit of Ppe Part 2KezNo ratings yet

- Bus Combination 2Document8 pagesBus Combination 2Angelica AllanicNo ratings yet

- Mas MockboardDocument12 pagesMas MockboardReynaldo corpuzNo ratings yet

- MasDocument12 pagesMasKenneth RobledoNo ratings yet

- MAS-Midterm Exam Name: - ScoreDocument15 pagesMAS-Midterm Exam Name: - ScoreRengeline LucasNo ratings yet

- Management Accounting & Controllership MCQsDocument12 pagesManagement Accounting & Controllership MCQssheena ouanoNo ratings yet

- Actual Amount P900,000 BDocument3 pagesActual Amount P900,000 BFerb CruzadaNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Part 2 - MA - Budgetary ControlDocument20 pagesPart 2 - MA - Budgetary ControlatikahNo ratings yet

- ACC 4052 - Course OutlineDocument11 pagesACC 4052 - Course OutlineatikahNo ratings yet

- Income from Subsidiary - Consolidation EntriesDocument6 pagesIncome from Subsidiary - Consolidation EntriesatikahNo ratings yet

- XYZ Consolidated Profit LossDocument2 pagesXYZ Consolidated Profit LossatikahNo ratings yet

- Inter-Company Sale of AssetsDocument10 pagesInter-Company Sale of AssetsatikahNo ratings yet

- MFRS 10 Consolidated Financial Statements ExplainedDocument10 pagesMFRS 10 Consolidated Financial Statements Explainedatikah0% (1)

- ACC 3501: Advanced Group AccountingDocument8 pagesACC 3501: Advanced Group AccountingatikahNo ratings yet

- MGT4760 Course OutlineDocument14 pagesMGT4760 Course OutlineatikahNo ratings yet

- Mfrs 3 - : Business CombinationsDocument10 pagesMfrs 3 - : Business CombinationsatikahNo ratings yet

- The Conceptual Framework For Financial ReportingDocument15 pagesThe Conceptual Framework For Financial ReportingatikahNo ratings yet

- QUESTION 4 - Financial-Reporting - QUESTION 4 - NEETADocument7 pagesQUESTION 4 - Financial-Reporting - QUESTION 4 - NEETALaud ListowellNo ratings yet

- BNL - WorkingDocument24 pagesBNL - WorkingB VaidehiNo ratings yet

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- trắc nghiệm part 2Document39 pagestrắc nghiệm part 2HankhnilNo ratings yet

- Chapter 12: Financial Statements: ObjectivesDocument22 pagesChapter 12: Financial Statements: Objectiveszain shujaNo ratings yet

- Underwriting of Shares and Debentures - PROBLEMSDocument4 pagesUnderwriting of Shares and Debentures - PROBLEMSSiddharth DhanrajNo ratings yet

- Account Title Unadjusted TB: Moises Dondoyano Information Systems CompanyDocument5 pagesAccount Title Unadjusted TB: Moises Dondoyano Information Systems CompanyJovie FabrosNo ratings yet

- Case CH 5Document2 pagesCase CH 5Faldi HarisNo ratings yet

- Week 1 IntroductionDocument28 pagesWeek 1 IntroductionAbhijit ChokshiNo ratings yet

- Arken Maja Blanca DelightDocument16 pagesArken Maja Blanca DelightKyle james Ovalo0% (1)

- FAC114 Financial Accounting Redemption of Preference SharesDocument4 pagesFAC114 Financial Accounting Redemption of Preference SharesDhairya ShahNo ratings yet

- Fm1-Sf Exam Part 2 Answer SheetDocument3 pagesFm1-Sf Exam Part 2 Answer SheetJudil BanastaoNo ratings yet

- Unit 4 Accounting Standards: StructureDocument16 pagesUnit 4 Accounting Standards: StructurefunwackyfunNo ratings yet

- Half year FY21 results overviewDocument35 pagesHalf year FY21 results overviewNima MoaddeliNo ratings yet

- Sage University, Indore Institute of Management StudiesDocument14 pagesSage University, Indore Institute of Management StudiesKalicharan PanchalNo ratings yet

- Owner's Equity Statement for Del Mundo PublishingDocument7 pagesOwner's Equity Statement for Del Mundo PublishingJayson FabelaNo ratings yet

- Singer Bangladesh - Financial AnalysisDocument24 pagesSinger Bangladesh - Financial AnalysisMd Nurul Hoque FirozNo ratings yet

- Block Hirt CH 2Document29 pagesBlock Hirt CH 2crystalNo ratings yet

- FINANCIAL MANAGEMENT April 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT April 20172016 PatternSemester IISwati DafaneNo ratings yet

- TB Chapter03 Analysis of Financial StatementsDocument68 pagesTB Chapter03 Analysis of Financial StatementsReymark BaldoNo ratings yet

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDocument5 pagesFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNo ratings yet

- Additional Funds Needed MasDocument22 pagesAdditional Funds Needed MasWilmer Mateo Bernardo100% (1)

- Current liability problems and solutionsDocument5 pagesCurrent liability problems and solutionsNoSepasi FebriyaniNo ratings yet

- Submitted By: Vivek SharmaDocument18 pagesSubmitted By: Vivek SharmaVe1kNo ratings yet

- Chapter 5Document56 pagesChapter 5mohamed faisalNo ratings yet

- Quick Notes in Financial Accounting and Reporting (Far) ProblemDocument5 pagesQuick Notes in Financial Accounting and Reporting (Far) ProblemArn HicoNo ratings yet

- Top Two Ways Corporations Raise CapitalDocument4 pagesTop Two Ways Corporations Raise CapitalSam vermNo ratings yet

- Accounting QuestionsDocument27 pagesAccounting QuestionsHarj SinghNo ratings yet

- PARTNERSHIP2Document13 pagesPARTNERSHIP2Anne Marielle UyNo ratings yet

- Mconsultingprep Com Case InterviewDocument72 pagesMconsultingprep Com Case InterviewTestNo ratings yet