Professional Documents

Culture Documents

What Are Institutions and Why Do They Matter For Development?

Uploaded by

Tigran0 ratings0% found this document useful (0 votes)

14 views34 pagesInstitutions | Economics of development (I don't own this)

Original Title

Ch 7 Institutions

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInstitutions | Economics of development (I don't own this)

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views34 pagesWhat Are Institutions and Why Do They Matter For Development?

Uploaded by

TigranInstitutions | Economics of development (I don't own this)

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 34

What are Institutions and Why

do they Matter for

Development?

Introduction.

Simple transaction in a developed economy:

buying a used car is difficult because of hidden

quality (Akerlof, 1970).

Methods have developed to alleviate this

problem: garage checks, warranties, databases

to track car history, regulations to protect

consumers.

In developing countries, hidden quality is not the

only problem. Car may be stolen, difficult to sue

or even track down the seller, consumers less

likely to be protected, courts work less well

This simple example for a simple transaction is

an illustration of the importance of institutions in

minimizing transaction costs and encouraging

economic development.

Introduction

In Singapore, it takes 6 days to start a business

(for 11 procedures),

In Congo, it takes 155 days for 13 procedures

In Venezuela, it takes 141 days for 14

procedures

In Laos, it takes 163 days for 8 procedures

In Vietnam, it takes 50 days for 11 procedures

In China, it takes 35 days for 13 procedures.

In India, the same.

In New Zealand, it takes 12 days for 2

procedures

In the US, 5 days for 5 procedures.

The institutionalist point of view

Fundamental concept for institutionalists is rule

of law: executive decisions can only be

exercised in accordance with written and

publicly disclosed laws. Moreover, law

enforcement itself follows well-established

procedures. The rule of law contrasts with

autocratic regimes.

Rule of law usually taken for granted but is

fragile or absent in many developing countries.

In advanced economies, took centuries to

establish.

The institutionalist point of view

Douglas North (Nobel prize in 1993) has argued

consistently that institutions are a key

determinant to explain success in development.

England introduced checks on power of the king,

gave power to the parliament, established rule of law

and was the first country to industrialize.

Spain had a very autocratic regime, despotism,

unbridled military spending and predatory

bureaucracy. Despite strong colonial conquests, gold

and power, Spain did not develop and became one of

Europes poorest countries until late twentieth century.

The institutionalist point of view

Institutionalist approach to economics

(North, Williamson, Acemoglu, Johnson,

Robinson ) claims that differences in

institutional setups in different countries

are a key factor to explain successes and

failures in development.

Why Doesnt capital flow from rich

to poor countries?

Robert Lucas (1990), other Nobel prize winner

estimated that a dollar invested in India should

earn a return 58 times (fifty-eight!) higher than a

dollar invested in the US economy.

Reason: So little capital in developing countries.

Truck with capacity of 25 tons to transport

wooden planks 10 miles easily replaces 4000

man-days of manual labor (assuming truck

makes 4 roundtrips and one man transports 50

pounds in one day)!

Why and where is this potential marginal

productivity lost if capital does not flow to poor

countries?

Why Doesnt capital flow form rich

to poor countries?

Weakness of institutions might account for this

puzzle.

Investments may be expropriated if property

rights not well protected.

Corrupt bureaucrats may extract bribes.

Contracts may not be respected.

Courts might not be helpful

Infrastructure may be lacking.

Local entrepreneurs face similar problems as

foreign investors and do not invest much.

What are Institutions?

Definition by Douglass North (1990: 3):

constraints on behavior imposed by the

rules of the game in society: Institutions

include any form of constraint that human

beings devise to shape human

interaction.

Includes formal and informal institutions.

Very broad definition as it includes social

norms.

Trade or steal?

Imagine Abuu, East African farmer on the road to

sell maize. He meets Nabil who sells cotton

tissue.

Economists are used to thinking that

advantageous trade will take place. But this

presupposes institutions.

Theft might be a more natural outcome.

Trade instead of violence presupposes

internalization of formal rule (fear of being

caught breaking the law) or informal rules of

behavior (ethical or religious rule of conduct).

Differences in institutions make

large differences.

If human energies can be channeled away from violent

activities towards peaceful and productive activities, it

makes a much larger difference than differences in skills

or endowments.

The level of human capital in Russia was quite high

before the fall of communism.

However, the institutions that emerged during the

transition process were not conducive to strong

development.

The Russian economy declined for many years. During

those critical years of early transition, the education

system suffered enormously and the level of human

capital in Russia started declining strongly. The high

level of initial human capital could not help Russia avert

economic decline.

Institutional diversity

Good institutions can reduce transaction costs, prevent

violence and predatory behavior and channel energies

towards productive activities.

Bad institutions can increase transaction costs and lead

to underdevelopment, violence and poverty.

A simple transaction like the purchase of a commodity

say a car, requires the transfer of a commodity from the

seller to the buyer and the transfer of cash from the

buyer to the seller. If the two operations are not

synchronized, there may be problems depending on who

moves first. The seller may never show up to deliver the

car or deliver a lemon. The buyer may never bring the

money.

The more sophisticated the transaction, the more

opportunities for cheating and predatory behavior.

Without adequate institutions, transactions would be

much more costly.

What are Institutions?

Recognizing that institutions are important is

only a first step. We must study different

institutions and their effects.

Distinction between formal and informal

institutions.

Formal institutions have written codified rules

enforced by the government. Ex: Political and

legal institutions.

Informal institutions are conventions, social

norms related to culture. Formal and informal

institutions interact.

Interaction between institutions.

Laws evolve with culture and social norms. Ex.:

Abolition of death penalty.

Tensions between informal and formal

institutions.

In Africa, arbitrariness of national boundaries

and continuation of ethnic loyalties. May lead to

violent conflicts but also different functioning of

government (nepotism seen as moral duty and

not a bad thing)

Difficulty of imposing laws that violate popular

religious obligations.

Interaction between institutions.

Complementarities between congruent

institutions: norm of honesty backed by

laws punishing cheating.

Tensions between formal and informal

institutions may lead to unexpected

consequences but may also destroy

traditional institutions without replacing

them (gender roles, kinship ties)

What do institutions do?

Provide different solutions to

1) informational problems,

2) hold-up problems,

3) commitment problems,

4) cooperation problems,

5) coordination problems

Informational problems.

Asymmetric information important in many transactions

(food, cars, software, houses), credit relation.

Example:

good second hand cars worth $10,000 to the seller and

$12,000 to the buyer.

Bad second hand cars worth $5,000 to the seller and

$4,000 to the buyer.

Without informational asymmetry, only good cars sell

and make $2,000 profit.

Assume informational asymmetry and 50% probability

car is good or bad. Risk neutral buyer ready to pay

5x12,000 + .5x4,000= $8,000 for a car. Suppliers

withdraw good cars and no cars sell. Market collapses.

particularly important in the case of credit. Lender may

not lend to honest borrower.

Assume good and bad borrowers. Good type is

creditworthy and needs money for a project with 10%

return. Bad type does not intend to pay back.

Assume bank must pay depositors 6% interest rate

(otherwise go to competing bank).

Without asymmetric information, bank lends only to good

borrower and gets 4% profit.

Under asymmetric information and 50-50 chance of

having good or bad borrower, needs to charge 12% to

pay depositors. Good borrower does not borrow since

can only make 10%, only bad borrower stays!

Adverse selection. Bad borrower chasing good

one.

Increasing credit rates does not balance market.

If excess demand for credit, higher interest rates

chase good borrowers and reduces profit of

banks!

Moral hazard. Borrower chooses risky project if

limited liability.

Other examples of moral hazard: land laborer

does not work hard on land, renters do not

maintain apartment, insured drivers are more

reckless, .

Solutions to informational problems

Legal solutions:

Disclosure rules

Regulation of entry in certain professions (lawyers

and doctors).

Contractual or spontaneous solutions:

Association of warranty to sales contract, return policy

Brand names, franchise contracts.

Chain stores as informational intermediaries. Rating

agencies (??), credit report companies, ebay ratings

Contractual solutions work best when backed by

the law (important for dispute resolution)

Solutions to informational problems

Under weak institutions, reputation and repeated

interaction are main instruments to overcome

informational problems.

Relational contracting. Lock-in in long term

relationship to have credible threat of

punishment.

Bad for competition and market development.

Markets and competition develop more

vigorously when good formal institutions are

present.

For reputation to work, importance of good

circulation of information. Poor countries have

weaker institutions and informal institutions work

less well.

The holdup problem.

One business partner holds up the other after an

investment is sunk.

Ex.: A company produces axles and signs contract with

truck company. Investment of 10,000 is needed and

variable cost of 20 per axle. Truck company promises a

price of 30 and orders 1,000 axles.

Axle company will break even. Costs = 10,000 +

20x1,000 = 30,000 and sales will be 30,000 also.

After the investment of 10,000 is made, the truck

company renegotiates and offers to pay only 25 per axle.

If the subcontractor refuses, loss is 10,000. If accepts,

payoff is 25x1,000 20x1,000 10,000= -5,000. Prefers

to accept! Reason is sunk cost.

Holdup problem hurts investment. Subcontractor would

not have invested if expected holdup!

The holdup problem.

Holdup problems are ubiquitous.

Holdup problem is more acute if relation-

specific investment. Axle investment used

only for truck company.

No informational asymmetries here, only

relation-specific investment (asset-

specificity), sunk investment and

opportunistic behavior.

Solutions to the holdup problem.

Binding and legally enforceable contracts

obvious solution to holdup problem. First order

effect.

Contracts are incomplete and do not completely

exclude holdup.

Vertical integration. Truck company produces

axles itself. Requires higher level of capital

(difficult for firms in developing countries where

weak formal institutions)!

Social norms do not work well if agents pursue

self-interest.

The commitment problem.

Commitment problem very general in economics and

human behavior in general. Arises with all sequential

transactions. The holdup problem is a particular

commitment problem.

Ex.: buyer does not pay, supplier does not deliver as

promised, or more subtle forms of reoptimization:

Budgets within bureaucracy, information arriving later,

The inability to commit hurts both parties because one

may forgo transactions profitable for both parties. The

inability to commit may weaken the bargaining power of

the party that is reoptimizing (soft budget constraints,

negotiating with terrorists) and its credibility (central

bank, monopoly with durable goods).

Solutions to the commitment problem

Formal contracts are first order. Third party

enforcement.

Informal means. Witnesses on markets.

Informal ways of signalling credibility:

cutting bridges, yakuza methods, making

large investment as commitment to

compete.

Informal enforcement agencies sometimes

used but often criminal orgin.

The cooperation problem.

The prisoners dilemma

B Stays Silent B confesses

Prisoner A serves ten years

A Stays Silent Both serve six months

Prisoner B goes free

Prisoner A goes free

A confesses Both serve two years

Prisoner B serves ten years

Symbol of inefficiency of self-interest maximization

The cooperation problem.

Protection of the environment.

Tragedy of the commons.

Collective action problem.

Different forms of association (Unions, parties,

NGOs, ) help overcome the cooperation

problem.

Political institutions help overcome the collective

action problem (democracy) or exacerbate it

(dictatorship).

International cooperation requires international

institutions.

The coordination problem.

Different from the cooperation problem.

Different equilibria are possible.

Ex.: Drive on the right or on the left.

Meet at the train station or airport.

Law abidance problem.

Tax evasion problem.

Solutions to the coordination problem.

Traffic laws and laws in general.

Regulation of standards. Rail tracks!

Many informal solutions: conventions

(calling back, nodding, body language, )

Cultural misunderstandings arise because

of incorrect decoding of conventions.

Focal points (Schelling, Nobel prize 2005).

Informal and formal institutions.

Informal institutions only do not give as

good a solution to the transaction

problems mentioned:

relational contracting bad for competition and

market development

reputation requires good circulation of

information

Enforcement of social norms relies on peer

pressure which works better under lack of

mobility, strong cohesion and rigid and closed

societies.

Why do institutions emerge?

Understanding what institutions do and how they emerge

are different questions.

We know what a microwave oven does but this does not

tell us how it was discovered.

Danger of functionalist fallacy, explaining the historical

emergence of an institution by what it does.

Inefficient institutions exist and persist (dictatorial

regimes, rampant corruption, inefficient courts,).

Overcoming inefficient institutions is difficult in part

because of the collective action problem.

Inefficient social norms also exist (discrimination against

women) and maybe even more difficult to overcome.

Conclusion.

Institutions matter for development as they

can solve many important transaction

problems, reduce transactions costs and

lead to higher development.

Difference between formal and informal

institutions.

We have seen what institutions do, we

have not seen how and why they emerge.

You might also like

- The Tax Analects of Li Fei Lao: Navigating Taxes, Business and Life In Asia: Including Taxation for US ExpatsFrom EverandThe Tax Analects of Li Fei Lao: Navigating Taxes, Business and Life In Asia: Including Taxation for US ExpatsNo ratings yet

- International Business 3 and 4Document7 pagesInternational Business 3 and 4Nawab AkhtarNo ratings yet

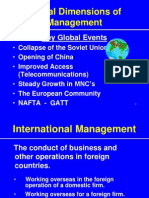

- Global Dimensions of ManagementDocument21 pagesGlobal Dimensions of ManagementSayli KarandikarNo ratings yet

- Economic Development in Asia - The Political Economy of Development in AsiaDocument40 pagesEconomic Development in Asia - The Political Economy of Development in AsiaJinky FerrerNo ratings yet

- Business Ethics: Lecturer: Eko Suwardi, PH.DDocument46 pagesBusiness Ethics: Lecturer: Eko Suwardi, PH.DahyaniluthfianasariNo ratings yet

- BSM940 Lecture2 Institutions and DevelopmentDocument20 pagesBSM940 Lecture2 Institutions and DevelopmentNishant ShahNo ratings yet

- LasagnaDocument39 pagesLasagnaRutvik ShahNo ratings yet

- MGX9660: International Business Theory & PracticeDocument33 pagesMGX9660: International Business Theory & PracticeripeNo ratings yet

- 2 Why Ethics in BusinessDocument24 pages2 Why Ethics in BusinessAnshul JainNo ratings yet

- 4 - Institutions and DevelopmentDocument26 pages4 - Institutions and DevelopmentAlemtideg AlemayehuNo ratings yet

- International ManagementDocument28 pagesInternational ManagementaxowirdNo ratings yet

- Political & Legal Environment of IBDocument27 pagesPolitical & Legal Environment of IBShashankNo ratings yet

- IB Fall 2023 - Lecture 5 - CH 6 - Political and Legal EnvironementDocument49 pagesIB Fall 2023 - Lecture 5 - CH 6 - Political and Legal EnvironementMansoor AliNo ratings yet

- Weeks 3 and 4: Transaction Costs, Asymmetric Information and Moral HazardDocument20 pagesWeeks 3 and 4: Transaction Costs, Asymmetric Information and Moral HazardMichelle Ngan DaoNo ratings yet

- Global Political EconomyDocument26 pagesGlobal Political EconomyAgustín TapiaNo ratings yet

- Norms and The Dynamics of Institution FormationDocument36 pagesNorms and The Dynamics of Institution FormationJust NattoNo ratings yet

- ETHICS AND SOCIAL RESPONSIBILITY Chap3Document20 pagesETHICS AND SOCIAL RESPONSIBILITY Chap3Viễn Nguyễn KýNo ratings yet

- CHAPTER 2 Rural DevelopmentDocument43 pagesCHAPTER 2 Rural Developmentayenewamsalu68No ratings yet

- Ibt Chapter 3&4Document8 pagesIbt Chapter 3&4Mairene CastroNo ratings yet

- Ethics HandoutsDocument5 pagesEthics HandoutsRonamae VillanuevaNo ratings yet

- Lecture Series III (ISM - 2007)Document61 pagesLecture Series III (ISM - 2007)api-3739202No ratings yet

- Lecture 5 (Ch. 5) Ethics and International BusinessDocument22 pagesLecture 5 (Ch. 5) Ethics and International BusinessShoppers CartNo ratings yet

- IB Class 2018pptDocument81 pagesIB Class 2018pptAvinash As AviNo ratings yet

- Dwnload Full Global Business Today 10th Edition Hill Solutions Manual PDFDocument35 pagesDwnload Full Global Business Today 10th Edition Hill Solutions Manual PDFarianazaria0d9gsk100% (8)

- Q-1 What Are The Ethical Issues Faced by Organizations inDocument4 pagesQ-1 What Are The Ethical Issues Faced by Organizations inurmila yadav100% (1)

- Forms and Functions of State and Non-StateDocument37 pagesForms and Functions of State and Non-Stateapril rancesNo ratings yet

- Institutions: Judicial Systems, Competition, Disclosure Requirements On Companies, LandDocument7 pagesInstitutions: Judicial Systems, Competition, Disclosure Requirements On Companies, LandJonny MillerNo ratings yet

- 2 - Institutions and DevelopmentDocument35 pages2 - Institutions and DevelopmentAlemtideg AlemayehuNo ratings yet

- Business Ethics in A Global EconomyDocument14 pagesBusiness Ethics in A Global EconomyHaniya KhanNo ratings yet

- Unit 2Document11 pagesUnit 2Mrudul MuraliNo ratings yet

- 1Document7 pages1manh dinhNo ratings yet

- Lecture 6 (Ch. 7) Political and Legal SystemsDocument26 pagesLecture 6 (Ch. 7) Political and Legal SystemsShoppers CartNo ratings yet

- Lecture 4Document24 pagesLecture 4RegNo ratings yet

- Eco741b - Ethics & Financial Regulations - IiDocument108 pagesEco741b - Ethics & Financial Regulations - Iibabie naaNo ratings yet

- Ethics Abdul Samad Memon 04091913005Document15 pagesEthics Abdul Samad Memon 04091913005Sarim ZiaNo ratings yet

- IBE UpdatedDocument14 pagesIBE UpdatedShan AliNo ratings yet

- Difference Between Moral Rights and Utilitarianism .???: Ethical Principles in Business:-Justice and FairnessDocument17 pagesDifference Between Moral Rights and Utilitarianism .???: Ethical Principles in Business:-Justice and FairnessIshan BhanotNo ratings yet

- Unit 20 Evolution of InstitutionsDocument24 pagesUnit 20 Evolution of InstitutionsHeet DoshiNo ratings yet

- Com 361: International Business: September 12, 2022Document463 pagesCom 361: International Business: September 12, 2022damonNo ratings yet

- Тopic 6Document4 pagesТopic 6Цибуляк ДаринаNo ratings yet

- Business Ethics 2Document52 pagesBusiness Ethics 2mamtakmr2No ratings yet

- Business Ethics in India PresentationDocument47 pagesBusiness Ethics in India PresentationSuraj Kumar SinghNo ratings yet

- Vian EheDocument4 pagesVian EheTabalan VanessaNo ratings yet

- Ethics and Social ResponsibilityDocument7 pagesEthics and Social ResponsibilityAzael May PenaroyoNo ratings yet

- Doing Business Internationally Involves More Than Just The Difference in CurrencyDocument3 pagesDoing Business Internationally Involves More Than Just The Difference in CurrencyFrank Kundeya0% (1)

- Anti Corruption PresentationDocument115 pagesAnti Corruption PresentationJaskaran SinghNo ratings yet

- Political and Legal Environments Facing BusinessDocument24 pagesPolitical and Legal Environments Facing BusinessRony TolingNo ratings yet

- Chapter 7Document45 pagesChapter 7tientran.31211021669No ratings yet

- Pyqs, Case Studies and Doubt Clearing SessionDocument55 pagesPyqs, Case Studies and Doubt Clearing SessionNAMRATA BHATIANo ratings yet

- TLE - Business ManagementDocument100 pagesTLE - Business ManagementManny HermosaNo ratings yet

- Business Ethics: Ethical Culture & Global BusinessDocument15 pagesBusiness Ethics: Ethical Culture & Global BusinessBoateng SilvestaNo ratings yet

- Ethical Issues in IBDocument24 pagesEthical Issues in IBVeena PanjwaniNo ratings yet

- Week 8 - Rational Choice Theory and Irrational BehaviorDocument14 pagesWeek 8 - Rational Choice Theory and Irrational BehaviorMuhammad Atique Ahmed 67-FMS/BSPA/F22No ratings yet

- Lesson 5: Nonstate Institutions and OrganizationDocument30 pagesLesson 5: Nonstate Institutions and OrganizationFelipe Mensorado GrandeNo ratings yet

- Evaluation 5 - Evaluation - CORR20024X Course Material - MexicoXDocument5 pagesEvaluation 5 - Evaluation - CORR20024X Course Material - MexicoXScribdTranslationsNo ratings yet

- Globalization and BEDocument19 pagesGlobalization and BEKaushka SunariNo ratings yet

- Chapter 4 International Trade LectureDocument50 pagesChapter 4 International Trade LectureRowena GarnierNo ratings yet

- English Q&A UpdatedDocument5 pagesEnglish Q&A UpdatedQusai AlautyatNo ratings yet

- MB0053Document6 pagesMB0053Rajni KumariNo ratings yet

- Global Business Management Political Risk and Negotiation Strategy Bba - IvDocument27 pagesGlobal Business Management Political Risk and Negotiation Strategy Bba - IvSHAMRAIZKHANNo ratings yet

- GENED Clusters Formation 2018Document7 pagesGENED Clusters Formation 2018TigranNo ratings yet

- Sourcing HacksDocument32 pagesSourcing HacksTigranNo ratings yet

- Feels Like Home: Welcome To Eyp ArmeniaDocument31 pagesFeels Like Home: Welcome To Eyp ArmeniaTigranNo ratings yet

- Sales Manual Hayk Mkrtchyan PresentationDocument4 pagesSales Manual Hayk Mkrtchyan PresentationTigranNo ratings yet

- Excel To-Do ListDocument2 pagesExcel To-Do ListTigranNo ratings yet

- Kasparov MyGreatesPredeccors NotesDocument2 pagesKasparov MyGreatesPredeccors NotesTigranNo ratings yet

- Starting A Day in A Life of Different ProfessionsDocument1 pageStarting A Day in A Life of Different ProfessionsTigranNo ratings yet

- EcclisiastesDocument3 pagesEcclisiastesTigranNo ratings yet

- O - I - Test Bank For IntroductionDocument4 pagesO - I - Test Bank For IntroductionTigranNo ratings yet

- Yerevan Summer Relativism Course DescriptionDocument1 pageYerevan Summer Relativism Course DescriptionTigranNo ratings yet

- Housing List 2016Document5 pagesHousing List 2016TigranNo ratings yet

- How To Change Your Life in 4 WeeksDocument7 pagesHow To Change Your Life in 4 WeeksTigranNo ratings yet

- MisDocument11 pagesMisTigran0% (1)

- Citizenship ProjectDocument17 pagesCitizenship ProjectRomika MittalNo ratings yet

- Andrews Powergrab Dictatorial Powers BillDocument116 pagesAndrews Powergrab Dictatorial Powers BillMichael SmithNo ratings yet

- NI V NZS & Ors (2019) 1 SHLR 32Document11 pagesNI V NZS & Ors (2019) 1 SHLR 32ambuk masamNo ratings yet

- Tort Law Exam Questions and AnswersDocument7 pagesTort Law Exam Questions and AnswersAhmed IbrahimNo ratings yet

- Tubes UtsDocument24 pagesTubes UtsDina RosidahNo ratings yet

- in Lea2 GroupDocument78 pagesin Lea2 GroupHaimelien De LimosNo ratings yet

- 2018 NAMCYA CHILDREN'S RONDALLA ENSEMBLE GuidelinesDocument3 pages2018 NAMCYA CHILDREN'S RONDALLA ENSEMBLE GuidelinesJohn Cedrick JagapeNo ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument4 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntarySushant YadavNo ratings yet

- Work Order: Add: IGST Add: SGST Add: CGST 0.00 5,022.00 5,022.00Document1 pageWork Order: Add: IGST Add: SGST Add: CGST 0.00 5,022.00 5,022.00VinodNo ratings yet

- Scroll Down To Complete All Parts of This Task.: Situation ResponseDocument15 pagesScroll Down To Complete All Parts of This Task.: Situation ResponseDaljeet SinghNo ratings yet

- Affidavit of Warranty: Republic of The Philippines) S.S. City of Batangas)Document2 pagesAffidavit of Warranty: Republic of The Philippines) S.S. City of Batangas)Leandra Alethea Morales100% (3)

- 06 Allan C Go V CorderoDocument2 pages06 Allan C Go V CorderoJJNo ratings yet

- 1st Year For Project Topics-1Document4 pages1st Year For Project Topics-1Clashin FashNo ratings yet

- APY Subscriber-Details Modification FormDocument3 pagesAPY Subscriber-Details Modification FormManoj GoyalNo ratings yet

- CIR vs. Seagate Technology (G.R. No. 153866 February 11, 2005) - H DIGESTDocument4 pagesCIR vs. Seagate Technology (G.R. No. 153866 February 11, 2005) - H DIGESTHarlene0% (1)

- Evidence Self Mock BarDocument7 pagesEvidence Self Mock BarNeil AntipalaNo ratings yet

- Ramos Case-DigestDocument2 pagesRamos Case-DigestKervy Sanell Salazar100% (1)

- Η απόπειρα πραξικοπήματος της 15ης Ιουλίου στην ΤουρκίαDocument185 pagesΗ απόπειρα πραξικοπήματος της 15ης Ιουλίου στην ΤουρκίαARISTEIDIS VIKETOSNo ratings yet

- Gimenez v. NazarenoDocument1 pageGimenez v. NazarenoMark Santiago ArroyoNo ratings yet

- Companies Act 1956Document17 pagesCompanies Act 1956Akash saxena100% (1)

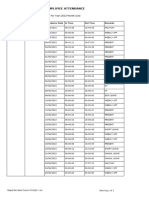

- Leave EmpAttendanceReportDocument1 pageLeave EmpAttendanceReportDeepak ParmarNo ratings yet

- Jammu/Srinagar: Finance Department (Codes Division) Civil SecretariatDocument2 pagesJammu/Srinagar: Finance Department (Codes Division) Civil SecretariatVishal ChoudharyNo ratings yet

- Spa - StocksDocument2 pagesSpa - StocksJerry AbrigoNo ratings yet

- Bab 3 Tangg Jawab & Prinsip PemuatanDocument27 pagesBab 3 Tangg Jawab & Prinsip Pemuatanardhan pratamaNo ratings yet

- A.D. v. DeMetro, Et Al. Filed ComplaintDocument13 pagesA.D. v. DeMetro, Et Al. Filed ComplaintjhbryanNo ratings yet

- Tugas SessionDocument4 pagesTugas SessionJoko Budiman100% (1)

- 2023 - 005 LGU Mayor PERMIT BENEFIT DANCEDocument1 page2023 - 005 LGU Mayor PERMIT BENEFIT DANCEbarangaybingayNo ratings yet

- President Donald Trump's 1776 Commission - Final ReportDocument45 pagesPresident Donald Trump's 1776 Commission - Final Reportcharliespiering98% (140)

- Zolo Assignment-1: Q. Why Were Jouline's Parents Skeptical About Coliving? What Can Be Done To Relieve Their Worries?Document2 pagesZolo Assignment-1: Q. Why Were Jouline's Parents Skeptical About Coliving? What Can Be Done To Relieve Their Worries?Kunal AgarwalNo ratings yet

- Commercial Transactions Notes - POWER OF ATTORNEYDocument8 pagesCommercial Transactions Notes - POWER OF ATTORNEYElizabeth ChilufyaNo ratings yet