Professional Documents

Culture Documents

IAS#16

Uploaded by

Shah Kamal0 ratings0% found this document useful (0 votes)

55 views17 pagesIAS#16

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIAS#16

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

55 views17 pagesIAS#16

Uploaded by

Shah KamalIAS#16

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 17

IAS # 16 PROPERTY,

PLANT AND EQUIPMENT

Objective of IAS 16

The objective of IAS 16 is to prescribe the accounting

treatment for property, plant, and equipment. The principal

issues are the timing of recognition of assets, the determination

of their carrying amounts, and the depreciation charges to be

recognized in relation to them.

Scope

While IAS 16 does not apply to biological assets related to

agricultural activity (see IAS 41) or mineral rights and mineral

reserves such as oil, natural gas and similar non-regenerative

resources, it does apply to property, plant, and equipment used

to develop or maintain such assets.

Recognition

Items of property, plant, and equipment should be

recognized as assets when it is probable that:

the future economic benefits associated with the asset

will flow to the enterprise; and

the cost of the asset can be measured reliably.

This recognition principle is applied to all property,

plant, and equipment costs at the time they are

incurred. These costs include costs incurred initially

to acquire or construct an item of property, plant and

equipment and costs incurred subsequently to add to,

replace part of, or service it.

Recognition

For many years the issue of replacement of part of an asset

(“subsequent costs”), often involving significant expenditure,

was a difficult matter to address

IAS 16 recognizes that parts of some items of property, plant,

and equipment may require replacement at regular intervals.

The carrying amount of an item of property, plant, and

equipment will include the cost of replacing the part of such an

item when that cost is incurred if the recognition criteria

(future benefits and measurement reliability) are met.

Initial Measurement

They should be initially recorded at cost. [IAS 16.15] Cost

includes all costs necessary to bring the asset to working

condition for its intended use. This would include not only its

original purchase price but also costs of site preparation,

delivery and handling, installation, related professional fees for

architects and engineers, and the estimated cost of dismantling

and removing the asset and restoring the site (see IAS 37,

Provisions, Contingent Liabilities and Contingent Assets).

If payment for an item of property, plant, and equipment is

deferred, interest at a market rate must be recognized or

imputed.

Exchange

If an asset is acquired in exchange for another

asset (whether similar or dissimilar in nature),

the cost will be measured at the fair value

unless (a) the exchange transaction lacks

commercial substance or (b) the fair value of

neither the asset received nor the asset given

up is reliably measurable. If the acquired item

is not measured at fair value, its cost is

measured at the carrying amount of the asset

given up.

Measurement Subsequent to Initial

Recognition

IAS 16 permits two accounting models:

Cost Model. The asset is carried at cost less

accumulated depreciation and impairment.

[IAS 16.30]

Revaluation Model. The asset is carried at a

revalued amount, being its fair value at the

date of revaluation less subsequent

depreciation, provided that fair value can be

measured reliably. [IAS 16.31]

The Revaluation Model

Under the revaluation model, revaluations should be carried

out regularly, so that the carrying amount of an asset does not

differ materially from its fair value at the balance sheet date.

[IAS 16.31]

If an item is revalued, the entire class of assets to which that

asset belongs should be revalued. [IAS 16.36]

Revalued assets are depreciated in the same way as under the

cost model (see below).

If a revaluation results in an increase in value, it should be

credited to equity under the heading "revaluation surplus"

unless it represents the reversal of a revaluation decrease of the

same asset previously recognised as an expense, in which case

it should be recognised as income. [IAS 16.39]

A decrease arising as a result of a revaluation should

be recognised as an expense to the extent that it

exceeds any amount previously credited to the

revaluation surplus relating to the same asset. [IAS

16.40]

When a revalued asset is disposed of, any revaluation

surplus may be transferred directly to retained

earnings, or it may be left in equity under the heading

revaluation surplus. The transfer to retained earnings

should not be made through the income statement

(that is, no "recycling" through profit or loss). [IAS

16.41]

Depreciation (Cost and Revaluation

Models)

For all depreciable assets:

The depreciable amount (cost less prior depreciation,

impairment, and residual value) should be allocated on a

systematic basis over the asset's useful life [IAS 16.50].

The residual value and the useful life of an asset should be

reviewed at least at each financial year-end and, if expectations

differ from previous estimates, any change is accounted for

prospectively as a change in estimate under IAS 8. [IAS 16.51]

The depreciation method used should reflect the pattern in

which the asset's economic benefits are consumed by the

enterprise [IAS 16.60];

The depreciation method should be reviewed at least

annually and, if the pattern of consumption of

benefits has changed, the depreciation method should

be changed prospectively as a change in estimate

under IAS 8. [IAS 16.61]

Depreciation should be charged to the income

statement, unless it is included in the carrying amount

of another asset [IAS 16.48].

Depreciation begins when the asset is available for

use and continues until the asset is derecognised, even

if it is idle.

Recoverability of the Carrying

Amount

IAS 36 requires impairment testing and, if

necessary, recognition for property, plant, and

equipment.

Any claim for compensation from third parties

for impairment is included in profit or loss

when the claim becomes receivable. [IAS

16.65]

Derecogniton (Retirements and

Disposals)

An asset should be removed from the balance

sheet on disposal or when it is withdrawn from

use and no future economic benefits are

expected from its disposal. The gain or loss on

disposal is the difference between the proceeds

and the carrying amount and should be

recognised in the income statement. [IAS

16.67-71]

Disclosure

For each class of property, plant, and

equipment, disclose: [IAS 16.73]

basis for measuring carrying amount;

depreciation method(s) used;

useful lives or depreciation rates;

gross carrying amount and accumulated

depreciation and impairment losses;

econciliation of the carrying amount at the beginning and the

end of the period, showing:

additions;

disposals;

acquisitions through business combinations;

revaluation increases;

impairment losses;

reversals of impairment losses;

depreciation;

net foreign exchange differences on translation;

other movements.

Also disclose: [IAS 16.74]

restrictions on title;

expenditures to construct property, plant, and

equipment during the period;

commitments to acquire property, plant, and

equipment.

compensation from third parties for items of property,

plant, and equipment that were impaired, lost or given

up that is included in profit or loss.

If property, plant, and equipment is stated at revalued amounts,

certain additional disclosures are required: [IAS 16.77]

the effective date of the revaluation;

whether an independent valuer was involved;

the methods and significant assumptions used in estimating

fair values;

the extent to which fair values were determined directly by

reference to observable prices in an active market or recent

market transactions on arm's length terms or were estimated

using other valuation techniques;

the carrying amount that would have been recognised had the

assets been carried under the cost model;

the revaluation surplus, including changes during the period

and distribution restrictions.

You might also like

- Property, Plant and EquipmentDocument8 pagesProperty, Plant and EquipmentMark John Malazo RiveraNo ratings yet

- Manage PPE AssetsDocument13 pagesManage PPE AssetsMich ClementeNo ratings yet

- Summary of IAS 16Document5 pagesSummary of IAS 16Laskar REAZNo ratings yet

- Chapter 09 Pas 16 PpeDocument9 pagesChapter 09 Pas 16 PpeJoelyn Grace MontajesNo ratings yet

- 12 PPE Part 1 With AnswersDocument13 pages12 PPE Part 1 With AnswersZatsumono YamamotoNo ratings yet

- FV provides transparency over historical costDocument3 pagesFV provides transparency over historical costHisham MalikNo ratings yet

- Ias 16 PropertyDocument6 pagesIas 16 PropertyAnjas A. M. TyasNo ratings yet

- Ias 16Document7 pagesIas 16Baqar BaigNo ratings yet

- IAS 16 SummaryDocument5 pagesIAS 16 SummarythenikkitrNo ratings yet

- These Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoDocument8 pagesThese Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoEki OmallaoNo ratings yet

- IAS 16 Accounting for Property, Plant and EquipmentDocument5 pagesIAS 16 Accounting for Property, Plant and EquipmentJoseph Gerald M. ArcegaNo ratings yet

- Summary of Pas 16 NDocument5 pagesSummary of Pas 16 NJenny Hermosado100% (1)

- IAS 16 PropertyDocument6 pagesIAS 16 PropertyMuhammad Salman RasheedNo ratings yet

- Accounting For PPEDocument4 pagesAccounting For PPEMaureen Derial PantaNo ratings yet

- ClassNotes IAS 16 PPEDocument2 pagesClassNotes IAS 16 PPEKhadejai LairdNo ratings yet

- SUMMARY OF IAS 16 PPE copyDocument3 pagesSUMMARY OF IAS 16 PPE copysecretary.feujpia2324No ratings yet

- Ias 16 Property Plant EquipmentDocument4 pagesIas 16 Property Plant Equipmentfaisal_zuhri100% (1)

- Ias 38Document43 pagesIas 38khan_ssNo ratings yet

- IAS 16 Overview: Accounting for Property, Plant and EquipmentDocument7 pagesIAS 16 Overview: Accounting for Property, Plant and Equipmentjustjade100% (1)

- IAS 16 Property, Plant and EquipmentDocument4 pagesIAS 16 Property, Plant and EquipmentSelva Bavani SelwaduraiNo ratings yet

- IAS-16 (Property, Plant & Equipment)Document20 pagesIAS-16 (Property, Plant & Equipment)Nazmul HaqueNo ratings yet

- Ias 16Document21 pagesIas 16Arshad BhuttaNo ratings yet

- Ias 16Document3 pagesIas 16Jhonalyn ZonioNo ratings yet

- Pas 16 Property, Plant and EquipmentDocument2 pagesPas 16 Property, Plant and Equipmentamber_harthartNo ratings yet

- Unit 1 and 2Document7 pagesUnit 1 and 2missyemylia27novNo ratings yet

- Ias 16Document7 pagesIas 16frieda20093835No ratings yet

- D5- Lê Trần Yến NhiDocument2 pagesD5- Lê Trần Yến Nhinhi lêNo ratings yet

- Theory of Accounting - SUMMARY of PPEDocument15 pagesTheory of Accounting - SUMMARY of PPESteven Chou100% (2)

- IAS 16 SummaryDocument7 pagesIAS 16 SummaryCharmaine LogaNo ratings yet

- Ias 16Document3 pagesIas 16CandyNo ratings yet

- IAS16Document2 pagesIAS16Atif RehmanNo ratings yet

- PP (A) - Lect 2 - Ias 16 PpeDocument19 pagesPP (A) - Lect 2 - Ias 16 Ppekevin digumberNo ratings yet

- IAS 16 Property Plant Equipment AccountingDocument6 pagesIAS 16 Property Plant Equipment AccountinghemantbaidNo ratings yet

- IAS 16 Property, Plant and Equipment GuideDocument35 pagesIAS 16 Property, Plant and Equipment GuideNimona BeyeneNo ratings yet

- Property, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Document37 pagesProperty, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Eshetie Mekonene AmareNo ratings yet

- Technical SummaryDocument2 pagesTechnical Summarysza_13100% (2)

- PAS 16: Property, Plant and EquipmentDocument21 pagesPAS 16: Property, Plant and EquipmentJoseph Gerald M. ArcegaNo ratings yet

- IFRS 6 EXPLORATION & EVALUATIONDocument8 pagesIFRS 6 EXPLORATION & EVALUATIONJoelyn Grace MontajesNo ratings yet

- Unit 1 - IAS 16: Property, Plant and Equipment Objective: Advanced Financial ReportingDocument18 pagesUnit 1 - IAS 16: Property, Plant and Equipment Objective: Advanced Financial ReportingRobin G'koolNo ratings yet

- Ias 16 PropertyDocument11 pagesIas 16 PropertyFolarin EmmanuelNo ratings yet

- Submitted By: - Muhammad Abdul Wahab Registeration No: 241 SUBMITTED TO: Madam Uzma Azam - Assignment No: 03 DATE OF SUBMISSION: 28-05-2021Document5 pagesSubmitted By: - Muhammad Abdul Wahab Registeration No: 241 SUBMITTED TO: Madam Uzma Azam - Assignment No: 03 DATE OF SUBMISSION: 28-05-2021Abdul WahabNo ratings yet

- Week 10 - 02 - Module 23 - Property, Plant & Equipment (Part 2)Document10 pagesWeek 10 - 02 - Module 23 - Property, Plant & Equipment (Part 2)지마리No ratings yet

- PPE HandoutsDocument6 pagesPPE Handoutsashish.mathur1No ratings yet

- IAS16 Defines Property, Plant and Equipment As "Tangible Items ThatDocument35 pagesIAS16 Defines Property, Plant and Equipment As "Tangible Items ThatMo HachimNo ratings yet

- Ias 16Document9 pagesIas 16ADEYANJU AKEEMNo ratings yet

- IAS 1 Presentation of Financial StatementsDocument74 pagesIAS 1 Presentation of Financial StatementsCandyNo ratings yet

- 07 PPE Cost s19Document35 pages07 PPE Cost s19Nosipho NyathiNo ratings yet

- Property, Plant and Equipment Are Tangible Items ThatDocument2 pagesProperty, Plant and Equipment Are Tangible Items ThatnasirNo ratings yet

- IAS 16 Property, Plant and Equipment GuideDocument5 pagesIAS 16 Property, Plant and Equipment GuideANURAG NairNo ratings yet

- Accounting Standard SWGDocument6 pagesAccounting Standard SWGAbhijit RoyNo ratings yet

- Ias 16 Property Plant Equipment v1 080713Document7 pagesIas 16 Property Plant Equipment v1 080713Phebieon MukwenhaNo ratings yet

- IAS 16 Property, Plant and Equipment GuideDocument12 pagesIAS 16 Property, Plant and Equipment Guideaditya pandianNo ratings yet

- 0915 IAS 16 Property Plant and Equipment Lecture Notes (Student Copy)Document13 pages0915 IAS 16 Property Plant and Equipment Lecture Notes (Student Copy)蔡易憬No ratings yet

- Ques. 1. Peterlee (A) - Purpose and Authoritative Status of The FrameworkDocument7 pagesQues. 1. Peterlee (A) - Purpose and Authoritative Status of The FrameworkJulet Harris-TopeyNo ratings yet

- Nepal Accounting Standards On Property, Plant and Equipment: Initial Cost 11 Subsequent Cost 12-14Document24 pagesNepal Accounting Standards On Property, Plant and Equipment: Initial Cost 11 Subsequent Cost 12-14Gemini_0804No ratings yet

- TA07b - Current AssetsDocument11 pagesTA07b - Current AssetsMarsha Sabrina LillahNo ratings yet

- BA 114.1 Handout On PPEDocument5 pagesBA 114.1 Handout On PPEHuarde SophiaNo ratings yet

- Mega Project Assurance: Volume One - The Terminological DictionaryFrom EverandMega Project Assurance: Volume One - The Terminological DictionaryNo ratings yet

- Industry Analysis TopicsDocument5 pagesIndustry Analysis TopicsShah KamalNo ratings yet

- F3 StudyText CIMA Kaplan 2015 Ver2 PDFDocument434 pagesF3 StudyText CIMA Kaplan 2015 Ver2 PDFShah Kamal100% (2)

- Summary - Differences Currency RM TechniquesDocument1 pageSummary - Differences Currency RM TechniquesShah KamalNo ratings yet

- Financial Instrument-Recogniton, MeasurementDocument60 pagesFinancial Instrument-Recogniton, MeasurementShah KamalNo ratings yet

- IAS#16Document17 pagesIAS#16Shah KamalNo ratings yet

- CIMA F3 SyllabusDocument8 pagesCIMA F3 SyllabusShah KamalNo ratings yet

- 15 Toughest Interview Questions and Answers!: 1. Why Do You Want To Work in This Industry?Document8 pages15 Toughest Interview Questions and Answers!: 1. Why Do You Want To Work in This Industry?johnlemNo ratings yet

- Project Stages - PlanningDocument20 pagesProject Stages - PlanningShah KamalNo ratings yet

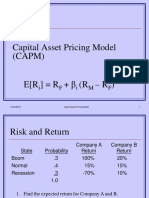

- Capital Asset Pricing ModelDocument25 pagesCapital Asset Pricing ModelShah KamalNo ratings yet

- Conceptual FrameworksDocument17 pagesConceptual FrameworksShah KamalNo ratings yet

- Chapter 5: Revenue (IAS 18) and Construction Contracts (IAS 11) MMPA - 501 Financial AccountingDocument50 pagesChapter 5: Revenue (IAS 18) and Construction Contracts (IAS 11) MMPA - 501 Financial AccountingShah KamalNo ratings yet

- Revenue and Its MeasurementDocument42 pagesRevenue and Its MeasurementShah KamalNo ratings yet

- Ifrs 8Document11 pagesIfrs 8TasminNo ratings yet

- IAS#38Document43 pagesIAS#38Shah KamalNo ratings yet

- Financial Instrument ClassificationDocument43 pagesFinancial Instrument ClassificationShah KamalNo ratings yet

- Ias 23Document18 pagesIas 23Shah KamalNo ratings yet

- Accounting Theory - Joint Conceptual Framework.Document15 pagesAccounting Theory - Joint Conceptual Framework.Shah KamalNo ratings yet

- Ias#32. 39 Ifrs 7Document38 pagesIas#32. 39 Ifrs 7Shah KamalNo ratings yet

- IAS 11 - Construction ContractDocument13 pagesIAS 11 - Construction ContractShah KamalNo ratings yet

- IFRS 5 Assets Held for Sale and Discontinued OpsDocument14 pagesIFRS 5 Assets Held for Sale and Discontinued OpsShah Kamal100% (1)

- Recent Changes in FASB FrameworkDocument6 pagesRecent Changes in FASB FrameworkShah KamalNo ratings yet

- IAS08Document29 pagesIAS08Shah KamalNo ratings yet

- IAS07Document22 pagesIAS073tsdu13No ratings yet

- IAS 19 - Employee BenefitDocument49 pagesIAS 19 - Employee BenefitShah Kamal100% (2)

- IAS#36Document31 pagesIAS#36Shah KamalNo ratings yet

- Ias 34Document11 pagesIas 34Shah Kamal100% (1)

- Calculate Zurich's taxable income and income taxes payable for 2007Document31 pagesCalculate Zurich's taxable income and income taxes payable for 2007Shah KamalNo ratings yet

- Ias 37Document22 pagesIas 37Shah KamalNo ratings yet

- Present Value TableDocument1 pagePresent Value TableShah KamalNo ratings yet

- (Final) Quiz Statement of Changes in Equity and Cash Flows Word FileDocument3 pages(Final) Quiz Statement of Changes in Equity and Cash Flows Word FileAyanna CameroNo ratings yet

- Preparing A Multiple Step Income StatementDocument2 pagesPreparing A Multiple Step Income StatementCyril Joseph ViernesNo ratings yet

- The Accounting EquationDocument4 pagesThe Accounting EquationMargo Williams100% (1)

- Module Sample ShsDocument8 pagesModule Sample ShsJoke JoNo ratings yet

- Advanced Corporate Reporting: Professional 2 Examination - November 2020Document16 pagesAdvanced Corporate Reporting: Professional 2 Examination - November 2020Issa BoyNo ratings yet

- Syllabus - Periyar UniversityDocument50 pagesSyllabus - Periyar UniversityShriHemaRajaNo ratings yet

- Deferred TaxDocument3 pagesDeferred Taxমোঃ মাহফুজুর রহমান রাকিবNo ratings yet

- Proposed DividebdDocument34 pagesProposed DividebdPiyush SrivastavaNo ratings yet

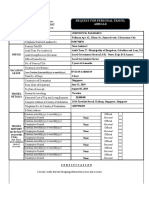

- Request For Personal Travel Abroad: Commonwealth Avenue, Quezon CityDocument5 pagesRequest For Personal Travel Abroad: Commonwealth Avenue, Quezon CityJonson PalmaresNo ratings yet

- Manufacturing Account Worked Example Question 7Document4 pagesManufacturing Account Worked Example Question 7Roshan Ramkhalawon100% (1)

- Auditing Theory Answer Key 6Document3 pagesAuditing Theory Answer Key 6Jasper GicaNo ratings yet

- Invoice SampleDocument1 pageInvoice SampleRinaldy ReiNo ratings yet

- Advanced Financial Accounting & Reporting Business CombinationDocument12 pagesAdvanced Financial Accounting & Reporting Business CombinationJunel PlanosNo ratings yet

- Siklus AkuntansiDocument15 pagesSiklus AkuntansiBachrul AlamNo ratings yet

- Liquidation ReportDocument3 pagesLiquidation Reportkabataansulong2023No ratings yet

- IFRS Framework ConflictsDocument16 pagesIFRS Framework ConflictsMJ YaconNo ratings yet

- Test Bank For Intermediate Accounting 17th Edition SticeDocument13 pagesTest Bank For Intermediate Accounting 17th Edition SticeLawrence Gardin100% (32)

- Auditing and Assurance Services in Australia 7th Edition Gay Test BankDocument41 pagesAuditing and Assurance Services in Australia 7th Edition Gay Test Bankpoulderduefulu1a4vy100% (26)

- Final Exam - Ae14 CfasDocument7 pagesFinal Exam - Ae14 CfasVillanueva RosemarieNo ratings yet

- FAR08.01d-Presentation of Financial StatementsDocument7 pagesFAR08.01d-Presentation of Financial StatementsANGELRIEH SUPERTICIOSONo ratings yet

- Capability - Table New (5) 20190825073712 (2) 20191229131437Document1 pageCapability - Table New (5) 20190825073712 (2) 20191229131437Varikuppala SrikanthNo ratings yet

- Essentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Ebook PDFDocument41 pagesEssentials of Accounting For Governmental and Not For Profit Organizations 13th Edition Ebook PDFkaty.wilkins325100% (32)

- Partnership PracticeDocument1 pagePartnership PracticeIce Voltaire Buban GuiangNo ratings yet

- (Materi 5) Audit Utang Jangka Panjang - Pengujian Substantif Terhadap Utang Jangka PanjangDocument5 pages(Materi 5) Audit Utang Jangka Panjang - Pengujian Substantif Terhadap Utang Jangka PanjangFendy ArisyandanaNo ratings yet

- GAAS GAADocument13 pagesGAAS GAAshudayeNo ratings yet

- Khuram Cement TuanaDocument115 pagesKhuram Cement TuanaZeeshan ChaudhryNo ratings yet

- Ch13 DISCLOSURE PRINCIPLESDocument6 pagesCh13 DISCLOSURE PRINCIPLESralphalonzoNo ratings yet

- Martin Corporat-WPS OfficeDocument3 pagesMartin Corporat-WPS Officelaica valderasNo ratings yet

- Practice Exam Chapter 1-3Document5 pagesPractice Exam Chapter 1-3Renz Paul MirandaNo ratings yet

- Bayan Telecommunications Holdings Corporation Fs 2006Document47 pagesBayan Telecommunications Holdings Corporation Fs 2006Pauline DyNo ratings yet