Professional Documents

Culture Documents

Job Order Costing - Sia and Medriano

Uploaded by

Richelle So Sia0 ratings0% found this document useful (0 votes)

13 views23 pagesJob Order Costing Report

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJob Order Costing Report

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views23 pagesJob Order Costing - Sia and Medriano

Uploaded by

Richelle So SiaJob Order Costing Report

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 23

Job Order

Costing

(Management Accounting)

SIA, RICHELLE & MEDRIANO,

MARVIN

Learning objectives:

• Explain job order costing system. What are the

businesses for which job order costing system is

ideal?

• Explain a job cost sheet. How is it prepared?

• What is a predetermined overhead rate? How is it

calculated?

• How various manufacturing as well as non-

manufacturing expenses are accumulated

or recorded under a job order costing system.

SIA, RICHELLE & MEDRIANO,

MARVIN

What is Job order costing

system?

It is generally used by companies that

manufacture a number of different products. It is

a widely used costing system in manufacturing as

well as service industries.

Per unit cost = Total cost applicable to job /

Number of units in the job

SIA, RICHELLE & MEDRIANO,

MARVIN

Job-Order Costing – An Overview

Charge

Charge direct

direct

Direct

DirectMaterials

Materials material

material and

and

Job

JobNo.

No.11 direct

direct labor

labor

costs

costs to

to each

each

Direct

DirectLabor

Labor Job

JobNo.

No.22 job

job as

as work

work

is

is performed.

performed.

Manufacturing

Manufacturing Job

JobNo.

No.33

Overhead

Overhead

• In a job-order costing system, direct materials and direct labor are

traced directly to each job as the work is preformed.

Sia, Richelle & Medriano,

Marvin

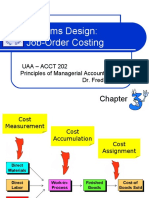

Direct Manufacturing

Costs

Manufacturing

Manufacturing

Overhead,

Overhead,

Direct

Direct Materials

Materials

including

including

Job

Job No.

No. 11

indirect

indirect

materials

materials and and

Direct

Direct Labor

Labor

indirect

indirect labor,

labor,

Job

Job No.

No. 22 are

are allocated

allocated

to

to all

all jobs

jobs

Manufacturing

Manufacturing Job

rather

rather than

than

Job No.

No. 33

Overhead

Overhead directly

directly traced

traced

to

to each

each job.

job.

What are the businesses for which job

order costing system is ideal?

• 51.1% of manufacturing companies in United

States use job order costing.

Manufacturing Business Service Business

Clothing factories Movie producers

Food companies Accounting firms

Air craft manufacturing Law firms

companies

Hospitals

SIA, RICHELLE & MEDRIANO,

MARVIN

What is Job Cost Sheet

• A document used to record manufacturing costs and is

prepared by companies that use job-order costing system to

compute and allocate costs to products and services.

E.g. of Manufacturing cost:

direct materials, direct labor, and manufacturing overhead

• Job cost sheet usually includes job number, product

name, starting date, completing date, number of units

completed etc.

E.g. of Job cost sheet in Manufacturing

materials requisition number, cost of direct materials

issued, time tickets, direct labor hours, direct labor rate

per hour and total cost, manufacturing overhead rate per

direct labor or machine hour and total cost etc.

SIA, RICHELLE & MEDRIANO,

MARVIN

Job Cost Sheet

SIA, RICHELLE & MEDRIANO, MARVIN

Steps in Job Order Costing System

1. Determine the direct materials requirement

• Bill of materials - document that lists the type and

quantity of direct materials required to manufacture a

standard product

• Production Staff - production department determines

materials requirement using the information provided by

customers. (customization in design, size, and color)

SIA, RICHELLE & MEDRIANO,

MARVIN

Steps in Job Order Costing System

2. Preparation of document known as ‘materials

requisition form.

3. Issuance of direct materials to production

department.

SIA, RICHELLE & MEDRIANO,

MARVIN

Journal entries to record the flow

of materials:

- There are two (2) types of journal entries are made for direct materials cost:

(1) One at the time of purchase of direct materials from suppliers, and

(2) One at the time of issuance of direct materials from storeroom to production

department.

When materials are purchased:

When materials are issued:

SIA, RICHELLE & MEDRIANO,

MARVIN

Measuring and recording direct

labor cost

• Similar to measuring and recording direct materials cost.

• Direct labor hours worked, direct labor rate per hour, and

total amount in dollars for each individual job or task is

recorded on a document known as time ticket or

employee time ticket.

• Any labor charges that are not directly traceable to a

particular job are known as indirect labor cost.

SIA, RICHELLE & MEDRIANO,

MARVIN

Journal entry to record direct labor

cost:

• After collecting time tickets by accounting

department, wages of workers are computed and

labor costs are classified as direct or indirect on

the basis of information provided by time tickets.

SIA, RICHELLE & MEDRIANO,

MARVIN

Measuring and recording

manufacturing overhead cost

• Manufacturing costs other than direct materials and

direct labor are known as manufacturing overhead

(also known as factory overhead).

• It consists of both variable and fixed components.

E.g. Cost include indirect materials, indirect labor,

depreciation, salary of production manager, property

taxes, fuel, electricity, grease used in machines, and

insurance etc.

• Since manufacturing overhead is an indirect cost that

cannot be directly assigned to each individual job. This

problem is solved by using a rate that is computed at

the beginning of each period. This rate is known

as Predetermined overhead rate.

SIA, RICHELLE & MEDRIANO,

MARVIN

Predetermined overhead rate

• It is used to apply manufacturing overhead to

products or job orders and is usually computed at

the beginning of each period by dividing

the estimated manufacturing overhead cost by

an allocation base (also known as activity

base or activity driver).

• Commonly used allocation bases are direct labor

hours, direct labor dollars, machine hours, and

direct materials.

SIA, RICHELLE & MEDRIANO,

MARVIN

Predetermined overhead rate

E.g.

Suppose ABC company uses direct labor hours to assign

manufacturing overhead cost to job orders. The budget

of the ABC company shows an estimated manufacturing

overhead cost of Php85,000 for the forthcoming year.

The company estimates that 1,000 direct labors hours

will be worked in the forthcoming year.

Using the above information, we can compute the

predetermined overhead rate as follows:

Predetermined overhead rate = Php85,000 / 1,000 hours

• = Php85.00 per direct labor hour

SIA, RICHELLE & MEDRIANO,

MARVIN

Multiple Predetermined

Overhead Rates

To this point, we have assumed that there is a single

predetermined overhead rate called a plantwide overhead

rate.

Large companies May be more complex

often use multiple but . . .

predetermined

overhead rates.

May be more accurate because

it reflects differences across

departments.

Over or under-applied

manufacturing overhead

• The difference between manufacturing overhead cost applied

to work in process and manufacturing overhead cost actually

incurred during a period.

• If the manufacturing overhead cost applied to work in process

is more than the manufacturing overhead cost actually

incurred during a period, the difference is known as over-

applied manufacturing overhead.

• If the manufacturing overhead cost applied to work in process

is less than the manufacturing overhead cost actually incurred

during a period, the difference is known as under-

applied manufacturing overhead.

SIA, RICHELLE & MEDRIANO,

MARVIN

Recording actual and applied overhead cost

in manufacturing overhead account:

• Over or under-applied manufacturing overhead is

actually the debit or credit balance of manufacturing

overhead account (also known as factory

overhead account).

• If manufacturing overhead account shows a debit

balance, it means the overhead is under-applied. On

the other hand; if it shows a credit balance, it means

the overhead is over-applied.

SIA, RICHELLE & MEDRIANO,

MARVIN

SIA, RICHELLE & MEDRIANO,

MARVIN

SIA, RICHELLE & MEDRIANO,

MARVIN

SIA, RICHELLE & MEDRIANO,

MARVIN

Thank You!

SIA, RICHELLE & MEDRIANO,

MARVIN

You might also like

- Job Order Costing: Presented byDocument15 pagesJob Order Costing: Presented bySumeet Shekhar NeerajNo ratings yet

- Ch7.JOB COSTINGDocument17 pagesCh7.JOB COSTINGDevendra MahajanNo ratings yet

- Managerial Accounting: Job-Order Costing SystemsDocument41 pagesManagerial Accounting: Job-Order Costing SystemsHibaaq AxmedNo ratings yet

- Ch7.Job CostingDocument46 pagesCh7.Job Costingalok296No ratings yet

- Accounting for Manufacturing Merchandising ActivitiesDocument85 pagesAccounting for Manufacturing Merchandising Activitiesafrahim100% (1)

- Week 11-Job Order CostingDocument103 pagesWeek 11-Job Order CostingrezaNo ratings yet

- Week 3 Job Order CostingDocument68 pagesWeek 3 Job Order CostingMichel BanvoNo ratings yet

- Acfm CH - Four 2022Document182 pagesAcfm CH - Four 2022mihiretche0No ratings yet

- ACT 202 Chapter 3 - UpdatedDocument53 pagesACT 202 Chapter 3 - UpdatedAminaMatinNo ratings yet

- Chp. # 3Document36 pagesChp. # 3CFANo ratings yet

- Systems Design: Job-Order CostingDocument71 pagesSystems Design: Job-Order CostingMd. Saidul IslamNo ratings yet

- Job-Order Costing: Chapter ThreeDocument68 pagesJob-Order Costing: Chapter ThreeMd Hasibul Karim 1811766630No ratings yet

- Chapter 3 - POHRDocument29 pagesChapter 3 - POHRNehal SalemNo ratings yet

- Job-Order Costing Flow CaloniaDocument18 pagesJob-Order Costing Flow CaloniaLaurever CaloniaNo ratings yet

- CH 3Document40 pagesCH 3nigoxiy168No ratings yet

- Process Cost SystemsDocument48 pagesProcess Cost SystemssajdahwasNo ratings yet

- Job-Order Costing: Cost Flows and External ReportingDocument57 pagesJob-Order Costing: Cost Flows and External ReportingGigo Kafare BinoNo ratings yet

- Management Accounting: Product CostingDocument22 pagesManagement Accounting: Product CostingDaksh AnejaNo ratings yet

- Chapter - 9 Job CostingDocument17 pagesChapter - 9 Job CostingMANISH VERMANo ratings yet

- Chapter 03Document68 pagesChapter 03Naimul HasanNo ratings yet

- Brewer9e Chap02 PPTDocument40 pagesBrewer9e Chap02 PPTtrungnt.studyNo ratings yet

- Systems Design: Job-Order Costing: Uaa - Acct 202 Principles of Managerial Accounting Dr. Fred BarbeeDocument22 pagesSystems Design: Job-Order Costing: Uaa - Acct 202 Principles of Managerial Accounting Dr. Fred BarbeeOrnica BalesNo ratings yet

- Ctivity Ased Osting Is As Simple As: A B C ABCDocument32 pagesCtivity Ased Osting Is As Simple As: A B C ABCsaptarshi_majumdar_5No ratings yet

- Hamsta - Direct Labour and FOHDocument21 pagesHamsta - Direct Labour and FOHHamstaNo ratings yet

- Managerial Accounting Chapter Two Job CostsDocument72 pagesManagerial Accounting Chapter Two Job CostsLay TekchhayNo ratings yet

- Kul 6 Dan 7 Job Order CostingDocument22 pagesKul 6 Dan 7 Job Order Costingkhoirul anwar assidiqNo ratings yet

- CM CH 2 Product Costing SystemsDocument43 pagesCM CH 2 Product Costing SystemsAkuntansi Internasional 2016100% (1)

- Chapter 03 Systems Design Job-Order CostingDocument38 pagesChapter 03 Systems Design Job-Order CostingFarihaNo ratings yet

- Chapter Six: Costing SystemsDocument92 pagesChapter Six: Costing SystemsreaderNo ratings yet

- IIM Rohtak Job Order Costing GuideDocument52 pagesIIM Rohtak Job Order Costing GuideSiddharthNo ratings yet

- CMA I - Chapter 4, Process CostingDocument68 pagesCMA I - Chapter 4, Process CostingLakachew GetasewNo ratings yet

- Chap003_Job Order CostingDocument30 pagesChap003_Job Order CostingnpfnowplayingNo ratings yet

- Systems Design: Job-Order CostingDocument67 pagesSystems Design: Job-Order CostingJellene GarciaNo ratings yet

- Introduction To Managerial Accounting and Cost ConceptsDocument17 pagesIntroduction To Managerial Accounting and Cost ConceptsvanessaNo ratings yet

- CH 4Document41 pagesCH 4nigoxiy168No ratings yet

- EMBA 5403 Costing SystemsDocument37 pagesEMBA 5403 Costing SystemsparulvijayNo ratings yet

- Chapter 6 - Job Order CostingDocument63 pagesChapter 6 - Job Order CostingXyne FernandezNo ratings yet

- Chap02 PPTDocument32 pagesChap02 PPTPb HNo ratings yet

- Act202 Chapter 3Document68 pagesAct202 Chapter 3yared debebeNo ratings yet

- Job OrderDocument69 pagesJob OrderSweet EmmeNo ratings yet

- Systems Design: Job-Order Costing: Managerial Accounting Dr. Fred BarbeeDocument19 pagesSystems Design: Job-Order Costing: Managerial Accounting Dr. Fred BarbeeAbdirazak MohamedNo ratings yet

- Job-Order Costing OverviewDocument20 pagesJob-Order Costing OverviewChau ToNo ratings yet

- Chapter 3Document40 pagesChapter 3Korubel Asegdew YimenuNo ratings yet

- Chap 002Document69 pagesChap 002haccp bkipmNo ratings yet

- (Revised) Week 13 - ReviewDocument94 pages(Revised) Week 13 - ReviewCheuk Ling SoNo ratings yet

- Managerial Accounting and Cost Concepts: Mcgraw-Hill/IrwinDocument55 pagesManagerial Accounting and Cost Concepts: Mcgraw-Hill/IrwinWaqas HussainNo ratings yet

- Manufacturing CostDocument22 pagesManufacturing CostadaneNo ratings yet

- Manac Knowledge Session - Mid TermDocument33 pagesManac Knowledge Session - Mid TermDebaloy DeyNo ratings yet

- Manufacturing BusinessDocument25 pagesManufacturing BusinessCristian Marlon De GuzmanNo ratings yet

- Session 4 Slides HandoutDocument13 pagesSession 4 Slides HandoutanxiaaNo ratings yet

- Process Costing Flows and CalculationsDocument13 pagesProcess Costing Flows and CalculationsDAN NGUYEN THENo ratings yet

- Hms 02Document64 pagesHms 02JavierNo ratings yet

- Akb Bab4Document37 pagesAkb Bab4MulyaniNo ratings yet

- Session 5 Job CostingDocument58 pagesSession 5 Job CostingJoeyNo ratings yet

- Costs Terms, Concepts and Classifications: Chapter TwoDocument54 pagesCosts Terms, Concepts and Classifications: Chapter TwosanosyNo ratings yet

- Job and Process IDocument19 pagesJob and Process IsajjadNo ratings yet

- Chapter 2 - Managerial Acc. & Cost ConceptsDocument23 pagesChapter 2 - Managerial Acc. & Cost ConceptsMuhammad Ali KazmiNo ratings yet

- Cost Terms, Concepts, and Classifications: Uaa - Acct 202 Principles of Managerial Accounting Dr. Fred BarbeeDocument41 pagesCost Terms, Concepts, and Classifications: Uaa - Acct 202 Principles of Managerial Accounting Dr. Fred Barbeekindergarten tutorialNo ratings yet

- Chapter 10 PPT Agm-1Document13 pagesChapter 10 PPT Agm-1Paulina DocenaNo ratings yet

- Fundamentals of Fast SwimmingDocument9 pagesFundamentals of Fast SwimmingTorcay Ulucay100% (1)

- EEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanDocument3 pagesEEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanBELJUNE MARK GALANANNo ratings yet

- Chapter 21Document39 pagesChapter 21Hamza ElmoubarikNo ratings yet

- 2016.05.16 - Org ChartDocument2 pages2016.05.16 - Org ChartMelissaNo ratings yet

- Simple Syrup I.PDocument38 pagesSimple Syrup I.PHimanshi SharmaNo ratings yet

- of Types of Nuclear ReactorDocument33 pagesof Types of Nuclear Reactormandhir67% (3)

- The Girls Center: 2023 Workout CalendarDocument17 pagesThe Girls Center: 2023 Workout Calendark4270621No ratings yet

- 8-26-16 Police ReportDocument14 pages8-26-16 Police ReportNoah StubbsNo ratings yet

- Aging and Elderly IQDocument2 pagesAging and Elderly IQ317537891No ratings yet

- Neurons and Nerve Impulses: Nandika Arora and Risa Gaikwad (11 G2)Document17 pagesNeurons and Nerve Impulses: Nandika Arora and Risa Gaikwad (11 G2)RisaNo ratings yet

- FileDocument284 pagesFileJesse GarciaNo ratings yet

- 2.1. Pharmacological Therapeutics. 2.2. Basic Cardiac Life Support (BCLS) and Advanced Cardiac Life Support (ACLS) in Neonates and ChildDocument3 pages2.1. Pharmacological Therapeutics. 2.2. Basic Cardiac Life Support (BCLS) and Advanced Cardiac Life Support (ACLS) in Neonates and Childclint xavier odangoNo ratings yet

- GSIS vs. de LeonDocument9 pagesGSIS vs. de Leonalwayskeepthefaith8No ratings yet

- Subaru Forester ManualsDocument636 pagesSubaru Forester ManualsMarko JakobovicNo ratings yet

- Q1 Tle 4 (Ict)Document34 pagesQ1 Tle 4 (Ict)Jake Role GusiNo ratings yet

- Chapter 4Document26 pagesChapter 4Lana AlakhrasNo ratings yet

- Characteristics of Uveitis Presenting For The First Time in The Elderly Analysis of 91 Patients in A Tertiary CenterDocument9 pagesCharacteristics of Uveitis Presenting For The First Time in The Elderly Analysis of 91 Patients in A Tertiary CenterFrancescFranquesaNo ratings yet

- Chennai's 9 sewage treatment plants process 486 MLDDocument5 pagesChennai's 9 sewage treatment plants process 486 MLDmoni_john_1No ratings yet

- The Impact of StressDocument3 pagesThe Impact of StressACabalIronedKryptonNo ratings yet

- Alternate Mekton Zeta Weapon CreationDocument7 pagesAlternate Mekton Zeta Weapon CreationJavi BuenoNo ratings yet

- Quality Control Plan Static EquipmentDocument1 pageQuality Control Plan Static EquipmentdhasdjNo ratings yet

- Growing Turmeric: Keys To SuccessDocument4 pagesGrowing Turmeric: Keys To SuccessAnkit ShahNo ratings yet

- Lesson Plan 7 Tabata TrainingDocument4 pagesLesson Plan 7 Tabata Trainingapi-392909015100% (1)

- EO On Ban of Fireworks (Integrated)Document2 pagesEO On Ban of Fireworks (Integrated)Mario Roldan Jr.No ratings yet

- XDocument266 pagesXTrần Thanh PhongNo ratings yet

- FB77 Fish HatcheriesDocument6 pagesFB77 Fish HatcheriesFlorida Fish and Wildlife Conservation CommissionNo ratings yet

- Fluid Mechanics Sessional: Dhaka University of Engineering & Technology, GazipurDocument17 pagesFluid Mechanics Sessional: Dhaka University of Engineering & Technology, GazipurMd saydul islamNo ratings yet

- 9 To 5 Props PresetsDocument4 pages9 To 5 Props Presetsapi-300450266100% (1)

- Hinduism Today April May June 2015Document43 pagesHinduism Today April May June 2015jpmahadevNo ratings yet

- Aplikasi Berbagai Jenis Media Dan ZPT Terhadap Aklimatisasi Anggrek VandaDocument15 pagesAplikasi Berbagai Jenis Media Dan ZPT Terhadap Aklimatisasi Anggrek VandaSihonoNo ratings yet