Professional Documents

Culture Documents

Macroeconomics

Uploaded by

purvi0 ratings0% found this document useful (0 votes)

27 views5 pagesmacroeconomics ppt

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmacroeconomics ppt

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views5 pagesMacroeconomics

Uploaded by

purvimacroeconomics ppt

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

How does monetary policy influence

inflation and employment?

• In the short run, monetary policy influences inflation

and the economy-wide demand for goods and

services--and, therefore, the demand for the

employees who produce those goods and services--

primarily through its influence on the financial

conditions facing households and firms.

• During normal times, the Federal Reserve has

primarily influenced overall financial conditions by

adjusting the federal funds rate--the rate that banks

charge each other for short-term loans.

• Movements in the federal funds rate are passed on to

other short-term interest rates that influence

borrowing costs for firms and households.

Movements in short-term interest rates also influence

long-term interest rates--such as corporate bond rates

and residential mortgage rates--because those rates

reflect, among other factors, the current and expected

future values of short-term rates.

• In addition, shifts in long-term interest rates affect

other asset prices, most notably equity prices and the

foreign exchange value of the dollar. For example, all

else being equal, lower interest rates tend to raise

equity prices as investors discount the future cash

flows associated with equity investments at a lower

rate.

• In turn, these changes in financial conditions affect

economic activity. For example, when short- and

long-term interest rates go down, it becomes cheaper

to borrow, so households are more willing to buy

goods and services and firms are in a better position

to purchase items to expand their businesses, such as

property and equipment.

• Firms respond to these increases in total (household

and business) spending by hiring more workers and

boosting production. As a result of these factors,

household wealth increases, which spurs even more

spending.

• These linkages from monetary policy to production and

employment don't show up immediately and are

influenced by a range of factors, which makes it

difficult to gauge precisely the effect of monetary

policy on the economy.

• Monetary policy also has an important influence on

inflation. When the federal funds rate is reduced, the

resulting stronger demand for goods and services tends

to push wages and other costs higher, reflecting the

greater demand for workers and materials that are

necessary for production.

• In addition, policy actions can influence expectations

about how the economy will perform in the future,

including expectations for prices and wages, and those

expectations can themselves directly influence current

inflation.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ICICI Bank Platinum Chip Credit Card Membership GuideDocument14 pagesICICI Bank Platinum Chip Credit Card Membership GuideVijay TambareNo ratings yet

- FFM 9 Im 13Document15 pagesFFM 9 Im 13Ernest NyangiNo ratings yet

- Αλφαβητάρι των οικονομικών PDFDocument36 pagesΑλφαβητάρι των οικονομικών PDFMarianthi AnastasopoulouNo ratings yet

- Junst2106036-Statement Huc0102 ContruccionDocument8 pagesJunst2106036-Statement Huc0102 Contruccioncarmen canturin cabreraNo ratings yet

- Pocket Catechism On The ConstitutionDocument114 pagesPocket Catechism On The ConstitutionTerry MilesNo ratings yet

- Chapter 3 ReceivablesDocument22 pagesChapter 3 ReceivablesCale Robert RascoNo ratings yet

- What Increases Demand For A Currency by BookMyForex MediumDocument2 pagesWhat Increases Demand For A Currency by BookMyForex MediumJoneskim KimoNo ratings yet

- " Money and Its History": AboutDocument13 pages" Money and Its History": AboutHarsha ShivannaNo ratings yet

- Harsh Patil - Tata Steel Working CapitalDocument82 pagesHarsh Patil - Tata Steel Working CapitalMayuresh100% (1)

- Macroeconomics Questions from 2013 Chinese Economics Exam AnalyzedDocument6 pagesMacroeconomics Questions from 2013 Chinese Economics Exam AnalyzedcankawaabNo ratings yet

- Capital Budgeting at Kesoram CementDocument12 pagesCapital Budgeting at Kesoram Cementammukhan khanNo ratings yet

- En Safe Pay HealthDocument21 pagesEn Safe Pay HealthOCTASYSTEMSNo ratings yet

- Sepa GuideDocument5 pagesSepa GuideSantosh Poojari0% (1)

- Background of The StudyDocument2 pagesBackground of The StudyAdonis GaoiranNo ratings yet

- Liquidity Adjustment FacilityDocument1 pageLiquidity Adjustment FacilityPrernaSharma100% (1)

- Chapter 23: Causes and Ending of HyperinflationDocument27 pagesChapter 23: Causes and Ending of HyperinflationSyafiq PhuaNo ratings yet

- Financial Statement 2014Document9 pagesFinancial Statement 2014shahid2opuNo ratings yet

- Sample Midterm Exam 2 Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkDocument2 pagesSample Midterm Exam 2 Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkRick CortezNo ratings yet

- DSCR Tutorial: Understanding the Debt Service Coverage RatioDocument2 pagesDSCR Tutorial: Understanding the Debt Service Coverage RatioArun Pasi100% (1)

- CIMB BANK Products and Services PresentationDocument20 pagesCIMB BANK Products and Services PresentationAzwin YusoffNo ratings yet

- Question BankDocument3 pagesQuestion BankMuhammad HasnainNo ratings yet

- Indian Accounting Standards OverviewDocument12 pagesIndian Accounting Standards OverviewREHANRAJNo ratings yet

- Final Work On BarclaysDocument5 pagesFinal Work On BarclaysKurstina RamsamyNo ratings yet

- CF (MBF131) Exam QDocument13 pagesCF (MBF131) Exam QSai Set NaingNo ratings yet

- MONEY, BANKING, AND MONETARY POLICY: UNDERSTANDING THE US FINANCIAL SYSTEMDocument9 pagesMONEY, BANKING, AND MONETARY POLICY: UNDERSTANDING THE US FINANCIAL SYSTEMKamalpreetNo ratings yet

- Cash For SeatworkDocument3 pagesCash For SeatworkMika MolinaNo ratings yet

- Forex Scaling Out Is Crucial For Money ManagementDocument4 pagesForex Scaling Out Is Crucial For Money ManagementThomas SteinNo ratings yet

- Thirteen Foundation 2015Document25 pagesThirteen Foundation 2015cmf8926No ratings yet

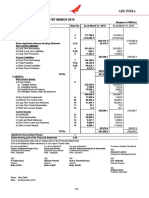

- Balance Sheet As at 31st March 2015Document1 pageBalance Sheet As at 31st March 2015Mrigul UppalNo ratings yet

- Manage finances and track expensesDocument7 pagesManage finances and track expensesSanjay VermaNo ratings yet