Professional Documents

Culture Documents

Chapter 4 Uses and Sources of STF and LTF

Uploaded by

Christopher Beltran CauanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 Uses and Sources of STF and LTF

Uploaded by

Christopher Beltran CauanCopyright:

Available Formats

4.

Sources and Uses

of Short-term

and Long-term

Funds

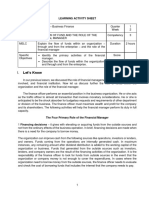

Learning Objectives -------------------------------------------- .

. .

. This chapter aims to achieve the following:

.

. Offer a good discussion on the specific fund .

. requirements of a business, and to identify the .

. available sources of funds; .

. .

. Explain the importance of matching fund

.

. requirements with specific sources of funds;

.

. Present the concept of working capital; and .

. .

Introduce personal finance specifically the sources

. .

of personal funds

. .

---------------------------------------------------------------------------

Mr. Christopher B. Cauan

Business Finance

4.1 Sources of

Funds for

Business

Operations

Mr. Christopher B. Cauan

Business Finance

Short-term Funds

Banks are usually your good source of short-term funds.

Short-term funds are used for business operations’ working capital.

This means that when you need to finance accounts

receivables or inventory, you usually turns to the banks for

short-term financing.

While sales are bought on credit or inventory needs to be

paid, business may turn to the banks for short-term

financing while cash has not yet been received or paid.

Mr. Christopher B. Cauan

Business Finance

Funding Working Capital

Savings account and current account are sources of

working capital.

Working Capital. Are current assets of your business that

are used in the operations (Eugene F

Brigham and Joel F. Houston, Essentials

of Financial Management)

These are usually in the form of cash, cash equivalents or

marketable securities, accounts receivables, and

inventory.

Mr. Christopher B. Cauan

Business Finance

For example, a thirty day bank loan, can finance a

business’ inventory. A short-term debt is usually one

year or less.

This means that a business can borrow to purchase

his inventory while he is waiting for cash or

available funds to arrive.

Mr. Christopher B. Cauan

Business Finance

Use of funds The Balance Sheets

Total Assets Total Liabilities and

Equity

Current Long-term Current Long-term Stockholder’s

Assets Assets Liabilities Debt Equity

Cash

Cash Equivalents/Marketable Aside from bank loans,

Securities other sources of short-term

Accounts Receivable

funds include credit from

suppliers (increasing

Inventory accounts payables) and

accrued liabilities.

Mr. Christopher B. Cauan

Business Finance

Uses of Working Capital

Net Working Capital or working capital is defined as

current assets less current liabilities.

Working capital helps carry out normal

operations of business.

Working capital is used to generate sales and

profits for a business.

Cash is churned to either invest in inventory or

to pay off short-term obligations so that the cost

of doing business is reduced.

Mr. Christopher B. Cauan

Business Finance

Marketable securities are used to generate

investment income through capital appreciation in

stock investments or trading through bond

investments.

Accounts receivables increase sales by making

buying more attractive to the customer with the

availability of credit.

Inventory is your product roster. The more

interesting your inventory, the greater potential sales

for your business.

Mr. Christopher B. Cauan

Business Finance

What are Long-term Funds and Why Do

Companies Need Long-term Funds?

Long-term funds are usually used for start-up

business requirements, or capital expenditures or

business expansion for existing businesses.

This means that when a business owner sees the

need or the opportunity for his business to grow

some more, he may invest in a building or

equipment that will sustain the growth of his

operations.

Mr. Christopher B. Cauan

Business Finance

The funds he will use for the building or the

equipment may usually be financed by long-term

funding from the banks. These may include a five-

year or a twenty-year loan.

However, in a corporate setup, long-term funds may

come from two major sources – debt and equity

from the investing public.

Corporations may acquire debt by issuing bonds, or

may raise capital by issuing preferred stock and

common stock.

Mr. Christopher B. Cauan

Business Finance

Banks

A bank is a financial intermediary that brings together

depositors and borrowers. Banks are a major source of

funding for our working capital requirements.

Commercial Banks

Its main business is lending.

Commercial bank clients are mostly retail customers.

They are the moms and dads in the neighborhood who

are either employed, self employed or who have small

businesses to operate.

Transactions are many and usually not very large in size.

They put up many branches in different locations to

reach more clientele.

Mr. Christopher B. Cauan

Business Finance

Other services of commercial banks include:

Loans for vehicle or home improvement.

Requiring collateral, security, and credit history of

loan.

Personal installment loans or credit history for loans.

Offering passbook, loans, and second mortgages.

Universal Banks

Licensed to do more sophisticated banking services

than commercial banks.

Clientele comprises of the top corporations of the

country and global businesses.

Their transactions are usually bigger in size,

multicurrency, and global in nature.

Mr. Christopher B. Cauan

Business Finance

Investment Banks

Similar to universal banks in terms of sophisticated

banking services.

They do not have branches all around the country.

They are more specialized and deal with top

corporations, global businesses, and governments.

They perform market making activities such as trading,

fund management, and portfolio management.

Mr. Christopher B. Cauan

Business Finance

Nonbanks

Nonbanks are financial intermediaries but are

supervised and regulated by another government body,

the Security and Exchange Commission.

Investment Companies

They pool your money together with the money of

other investors and invest these in financial

instruments – stocks, bonds, currencies, commodities,

financial derivative.

Mr. Christopher B. Cauan

Business Finance

They managed this pool of funds which are called

mutual funds.

Mutual funds are sold based on a net asset value per

unit.

Insurance Companies

Sell coverage or protection from events such as (1) a

death of a loved one, (2) fire, or (3) accident.

Insurance premiums are paid by the owner/buyer over

a time such as from 5-10 years, in exchange for the

coverage.

Mr. Christopher B. Cauan

Business Finance

In return, the insurance companies manage the

premiums by investing the same in financial

instruments that offer good returns – stocks, bonds,

currencies, commodities, financial derivatives or real

estate.

Other service that an insurance company offers

include:

Lend on cash value of the insurance policy.

Offer single payment or partial payment

loans.

Mr. Christopher B. Cauan

Business Finance

Private Equity Funds

Funds of private investors used to finance lucrative

projects that are projected to give good returns.

They are big in Europe because the market has grown

and investors have become more sophisticated, more

knowledgeable, and are trying to move away from

regulated investments and funds.

Mr. Christopher B. Cauan

Business Finance

4.2 Requirements

of Applying

for a Personal

Loan

Mr. Christopher B. Cauan

Business Finance

The borrower promises to return the property or money after an agreed

period of time.

The payment for the use of property or money is called interest.

The agreement is usually documented through a Promissory Note, connoting a

promise to pay back the owner for the use of the property or cash.

Debt is the obligation to pay back property or cash borrowed in accordance to

an agreement, and this may be in the form of notes, bonds, or mortgage

Credit is a loan or money extended to a person or business in exchange for a

return.

Once issued, it becomes a debt of the borrower.

When the money is extended, there is a pre-agreed covenant, such as

how long the credit payment is extended, how much, and how much

will be returned, how frequent, at what interest rate.

Mr. Christopher B. Cauan

Business Finance

Credit Analyst holds the important role of analyzing the financial track record of

the person or the business that borrows, as well as its financial transactions.

He determines the credit rating of the borrower by looking at trends and

forecasting potential payback on the loan.

What affects credit ratings?

Ability to repay the loan.

Character of the borrower.

Capacity to pay the loan.

Capital and personal assets.

Collateral and size of business assets.

Credit Bureau is the agency that gathers information about the credit history of the

borrower and sells this information for a fee.

Banks keep credit information private and confidential (Philippines)

Credit Bureaus has been recognized and existed (U.S)

Mr. Christopher B. Cauan

Business Finance

Insolvency is the is the inability to pay debts on time when they are due.

It is not the same as bankruptcy.

Insolvency is insufficiency of cash flow and is temporary.

Insolvency or illiquidity is already an indication of trouble.

The acknowledgement of insolvency is a step toward managing your credit

better.

Bankruptcy is the last remedy to declare, if you suffer from debt problems.

Is a legal process wherein assets of a debtor are distributed to creditors to be able

to pay his debts.

Bankruptcy also includes a plan to repay creditors on an installment basis.

Declaring bankruptcy severely damages one’s credit rating.

Net worth is the value of your assets, cash, savings, real state, cars, stock, bonds,

jewelry collection, insurance, and art collection.

The net worth value is deducted from your debt including credit card debts,

monthly bills, auto loans, home loans, and medical bills.

Mr. Christopher B. Cauan

Business Finance

A personal budget helps you track your financial assets and financial activities

A successful and effective budget will have the following.

Information based on past spending and expectations.

No single expense, rent, and utilities should not consist of 50%

of your gross income.

Must be flexible for modification if important considerations

change, i.e, income, marital status, new spending habits, new

medical expenses.

Easy access any time – file folders, a notebook, a computer file

may be used to store the budget for any need and update.

Mr. Christopher B. Cauan

Business Finance

Factors affecting your personal buying decision

Personal values

Available time for research

Take home pay

Access to the product/service

Benefits of a brand

When buying a car, for example, what are the major considerations?

Mechanisms to improve performance such as larger engine

anti-lock brakes, cruise control.

Convenience like stereo and tinted windows.

Visual options like style.

Mr. Christopher B. Cauan

Business Finance

Loan Amortization and the Loan Application Process

Lending is the commercial bank’s bread and butter.

This is where banking earns and pays his employees, whose salaries, in turn are

reserved for several purposes.

Personal Loan, he will be assessed on the basis of his personal financial capacity

What is his age?

What is his occupation?

Where does he live?

How many cars does he have?

How many children does he have?

What is his business?

Mr. Christopher B. Cauan

Business Finance

Business Loan, the application will ask for information to be able to determine the

capacity of the business to repay the loan.

What is the nature of the business?

How long has the business been in operation?

How much revenues accrued in the last three years?

How much were profits for the last three years?

What is the size and value of the business?

What is the size and value of the properties of the business?

Available pertinent information Loan Officer Manager

Credit Committee Credit Officer

Mr. Christopher B. Cauan

Business Finance

Credit Committee

This group of officers represents the financial institutions, creditors and/or

investors that have claims on a company that is in financial difficulty or

bankruptcy.

Their role begins in approving the credit line and credit terms for a business,

monitoring the payments schedule as agreed on, and filing for bankruptcy or

initiating the claims procedures if the business operations fail.

Credit Ratings

Credit ratings are a way to formally evaluate the credit history of a person or

company and that includes a forecast of its capability to repay obligations.

Normally begin with the company’s 3-5 year financial statements, a review of

its business operations, a review of the economic conditions the company

operates in, the stability and credibility of the business owners and

management, and a forecast on revenues and the bottomline.

Mr. Christopher B. Cauan

Business Finance

What is Credit Analyst?

The credit analyst evaluates the borrower’s financial standing by reviewing

his financial statements. The borrower here is usually a company or

corporation.

The credit analyst evaluates statistics and analyzes corporate records

including (1) payment plans (2) savings data (3) payment history

(4) purchase activity

Based on these records, the credit analyst makes a recommendation to his

lending officer whether to extend credit to the borrower or not, after

determining his credit worthiness and/or credit limit.

Mr. Christopher B. Cauan

Business Finance

The credit analyst’s job involves a lot of critical thinking, judgment, and

decision-making.

TheVery Important Cs of Credit

Character

How long has credit been used before?

How long has the borrower lived in the present address?

How long has he held the same job?

Capacity

Who is the current employer and how much is the current

salary?

What are other sources of income?

What are the current debts?

Mr. Christopher B. Cauan

Business Finance

Capital

What are his/her assets?

What are his/her liabilities?

Are the assets enough to pay for the debts?

Collateral

What assets do you have to secure the loan (a vehicle, your

home, furniture)?

What investments or savings you have?

Conditions

General economic conditions such as unemployment and

recession can affect the ability to pay a loan. Focuses on the

security of your job and the company that employ you.

Mr. Christopher B. Cauan

Business Finance

ImprovingYour Credit Score

Pay your bills on time.

Lower your balances.

Set a monthly date wherein you can pay a certain amount

regularly if you are not able to pay the entire balance.

Target paying the entire balance all the time.

Delay or forgo unimportant purchase like luxury items.

Use credit wisely.

ProtectingYour Credit fromTheft or Loss

Credit can be stolen from you. If you never charged those goods and

services, someone else may have had used your name, and used your

personal information to commit fraud.

Mr. Christopher B. Cauan

Business Finance

What should you do?

Report the crime to the credit bureau immediately.

Report the crime to the creditor immediately.

File a police report immediately.

How do you prevent this?

Shred papers that contain personal information, especially

financial.

Be sure your credit card is returned after a purchase.

Keep a record of credit card numbers.

Keep records separate from your cards.

Mr. Christopher B. Cauan

Business Finance

Signs of debts problems

Only minimum monthly payments are paid.

There is a struggle to make monthly payments on credit card

bills.

The total balance on the credit card bills increases every month.

Loan payments are missed or are very late.

Savings are used to pay food and utilities.

Notices are sent by creditors.

You borrow money to pay off old debts.

You exceed credit limits.

You have been denied credit because of bad credit report.

Mr. Christopher B. Cauan

Business Finance

What is Personal Bankruptcy?

When an individual suffers from extreme case of debt

problems, he can declare bankruptcy.

Bankruptcy is the legal process where he sells some or all of his

assets, or his assets are distributed to his creditors because he is

unable to pay his debts.

It may also include a plan to repay creditors on an installment

basis.This severely damages ones credit rating.

The Cost of Credit

You should first figure out how much the loan will cost you, if

you are taking out a loan or borrowing or applying for a credit

card .

Mr. Christopher B. Cauan

Business Finance

There are two costs that a credit card holder should know.

1. The Finance Charge.

This is the total amount you pay to used credit.

In most cases, this is the amount paid to the credit card company for any

unpaid balance.

The finance charge is calculated using the annual percentage rate.

2. The Annual Percentage Rate

The annual percentage rate(APR) is the cost of credit on a yearly basis

expressed in percentage points.

An APR of 18% means that you pay ₱ 18.00 for every ₱ 100.00 you

charged the credit card company or for every ₱ 100.00 you owe.

The credit card company must inform you in writing before you sign any

agreement, in relative to the finance charge and the APR.

Mr. Christopher B. Cauan

Business Finance

4.3 Flowchart of

a Loan

Application

Mr. Christopher B. Cauan

Business Finance

Filling out the Loan

Application Form Amount of loan needed

Purpose of Loan

Name of borrower

Credit History Address of borrower

Present salary /Information Social Security System

Number of dependents of the Number

Other sources of income Borrower Present employer

Past credit/history

Bank accounts

Marital Status

Credit Find out the reason why

Processing and appeal to the

creditor or apply with

by Committee

another creditor.

Requirements may be

different with another

Credit is Credit is company

approved denied

-Own illustrations, Source: Kapoor, Dlabay, Hughes, Personal Finance

Sole Proprietorship and the Business Documentation

Requirements

Business Loan Requirements

Copy of Valid Identification

Bureau of Internal Revenue Registration Certificate

Department of Trade and Industry Certificate

Business Permit or Mayor’s Permit

Settlements Procedure and details

Mr. Christopher B. Cauan

Business Finance

Requirements

Identification

The following may be accepted:

Passport ID

Any government-issued ID

School ID

Voter’s ID

Picture in the ID must be clear

The ID must have a recent signature

Bureau of Internal Revenue (BIR) Registration Certificate,

Department of Trade and Industry (DTI) Certificate

Both ensure that the business had gone through the proper procedures and

compliance with the BIR and DTI.

Certificates must be updated and not expired.

Mr. Christopher B. Cauan

Business Finance

Business Permit

The business permit must be current and updated.

If the business is undergoing renewal, a clear copy of the business permit

application for renewal must also be submitted as part of the requirements

for a business loan.

Official receipt of proof of payment must be submitted - for ongoing

process of renewal

Settlement Bank Account

Facilitates the more efficient payment of interest on the loan.

Through electronic/mobile/internet funds transfer to the bank account

Through bank checks

Passbooks with complete name and account number as proof of regular

loan payments

Mr. Christopher B. Cauan

Business Finance

What is bad credit? How does bad credit happen?

Bad credit happens when companies are unlikely to pay their debts. They are

illiquid, their debts are not paid on time, or could go bankrupt, which

means that their assets even if sold, would not be enough to pay for their

debts.

Bad credit happens when company sales do not grow over time and when

company expenses increase faster than sales.

This is why growing companies are always on the lookout for new products

and new business opportunities.

Mr. Christopher B. Cauan

Business Finance

4.4 Obligations of

Entrepreneurs

to Creditors

Mr. Christopher B. Cauan

Business Finance

A key partner of the entrepreneur is his creditor bank.

His bank extends him a line for his daily business requirements as well as

his requirements for longer term capital expansion.

In return, the entrepreneur keeps his promise to pay back his creditor

banks by ensuring that he is financially capable and that his business is

sustainable.

How can he ensure that this happens?

Business activities such as annual corporate planning, strategic planning, a

review of his business from the top level help, including a forecast of where

the economy is going.

A forecast is an analysis of a company’s strengths, weaknesses, opportunity,

and threats.

It enhance its competitiveness, profitability and sustainability.

Scan of the macroeconomic background his business operates will help him

the future of the business.

Mr. Christopher B. Cauan

Business Finance

The Business Owner and Creditor as Partners in Growing a

Business

The Business Entrepreneur Complies with Regulation

Financial Institution provides the funds and offers financial services and

financial advise.

To assist the financial institution facilitate the service, the entrepreneur

does the following:

Continuous submission of financial reports to assure regular and

prompt payments of his obligations.

Yearly walk through the business operations to review, assess,

and improve the business.

Annual corporate planning to determine what needs to be done

to increase sales.

Mr. Christopher B. Cauan

Business Finance

Annual strategic planning to identify growth areas in the

business and to assess where innovation can help business

efficiency.

Regular discussion on cost and operating controls.

Financial management is identifying where to source funds, how

to raise cheap funds, how to keep costs down, paying debts on

time.

Managing debts, avoiding delayed payments, avoiding

bankruptcy and during bankruptcy, the orderly liquidation of

assets, and payment to creditors.

Mr. Christopher B. Cauan

Business Finance

4.5 Uses of Funds

Mr. Christopher B. Cauan

Business Finance

ForWorking Capital

Business working capital is used for the business’ day-to-day activities,

and this refers to the current assets and the current liabilities of the

company.

What are your current assets?

Cash, marketable securities, accounts receivables, and inventory are

resources a business can work with to be able to generate sales and

revenues.

Too much inventory carried can be costly. On the other hand, too little

inventory may limit sales for the company.

Mr. Christopher B. Cauan

Business Finance

For Capital Expenditures, To Reinvest in the

Business, For Business Expansion

Funds used for long-term investments as opposed to your day-to-day

operations are usually:

1. Revenue enhancing as a result of research and development;

2. Cost reducing new equipment or technology; and

3. Required investments due to a government regulation health or

pollution.

For Debts Servicing

Funds are also used to pay for debts. As a general rule, debts should be

self-liquidating.

The cash needed to pay short-term loan should be generated from the

sale and immediately pay the debt.

Mr. Christopher B. Cauan

Business Finance

End of

Chapter 4

Mr. Christopher B. Cauan

Business Finance

You might also like

- Royal Sick FucksDocument335 pagesRoyal Sick FucksanonknowladgeNo ratings yet

- Lecture Notes of Working Capital ManagementDocument9 pagesLecture Notes of Working Capital Managementমোঃ আশিকুর রহমান শিবলু100% (1)

- AN To Financial Management: Business Finance Mr. Christopher B. CauanDocument37 pagesAN To Financial Management: Business Finance Mr. Christopher B. CauanClintonNo ratings yet

- Entrepreneurship-CHAPTER SIXDocument9 pagesEntrepreneurship-CHAPTER SIXSyerwe Gkjl GdfNo ratings yet

- Entrepreneurship CH 6Document27 pagesEntrepreneurship CH 6AYELENo ratings yet

- Unit VDocument9 pagesUnit VJayNo ratings yet

- Cha 6 EntrDocument40 pagesCha 6 Entrtot stephenNo ratings yet

- CHAPTER 6Document47 pagesCHAPTER 6kirubel solomonNo ratings yet

- BUSINESS FINANCING CHAPTER: SOURCES AND TYPESDocument31 pagesBUSINESS FINANCING CHAPTER: SOURCES AND TYPESYemane Admasu GebresilassieNo ratings yet

- Chapter 8 JasonJamesDocument38 pagesChapter 8 JasonJamesAnthony James L. PinoNo ratings yet

- Ch. 6Document3 pagesCh. 6Bare SharmakeNo ratings yet

- 3 5 EntrepDocument11 pages3 5 EntrepKristel Mae CastilloNo ratings yet

- Chapter 7 Source of Finance PDFDocument30 pagesChapter 7 Source of Finance PDFtharinduNo ratings yet

- Business Finance ModuleDocument41 pagesBusiness Finance ModulerhyzeNo ratings yet

- Management of Business Grade 12 Module 3: Business Finance and AccountingDocument3 pagesManagement of Business Grade 12 Module 3: Business Finance and AccountingMartinet CalvertNo ratings yet

- CHAPTER - 6 FinancingDocument19 pagesCHAPTER - 6 FinancingTesfahun TegegnNo ratings yet

- Business Finance Week 1-2Document9 pagesBusiness Finance Week 1-2Luis Dominic A. CrisostomoNo ratings yet

- Bus Finance - 404 ReportDocument5 pagesBus Finance - 404 ReportKinouchi DanielNo ratings yet

- Sources of Finance & Capital StructureDocument13 pagesSources of Finance & Capital Structurebchege55200No ratings yet

- Chap-11 Business Finance and Fundamentals of AccountingDocument23 pagesChap-11 Business Finance and Fundamentals of AccountingSiffat Bin AyubNo ratings yet

- FM TheoryDocument23 pagesFM TheoryBhavya GuptaNo ratings yet

- Scope and Nature of Finance ManagementDocument19 pagesScope and Nature of Finance ManagementKishan Kumar SahuNo ratings yet

- Business Finance Notes Finals TermDocument3 pagesBusiness Finance Notes Finals TermMary Antonette VeronaNo ratings yet

- 647983621f0e830018bf92fb - ## - Scope and Objectives of Financial Management - E-Notes - Udesh Regular - Group 2Document14 pages647983621f0e830018bf92fb - ## - Scope and Objectives of Financial Management - E-Notes - Udesh Regular - Group 2cofinab795No ratings yet

- Scope and Objectives of Financial Management _ E-Notes __ Udesh Regular- Group 2Document14 pagesScope and Objectives of Financial Management _ E-Notes __ Udesh Regular- Group 2ManavNo ratings yet

- Sources of FundDocument16 pagesSources of FundRonak ShahNo ratings yet

- Sources of Finance GuideDocument9 pagesSources of Finance GuideN Durga MBANo ratings yet

- Financial Services 1Document42 pagesFinancial Services 1Uma NNo ratings yet

- Unit III Sources of Capital... EpDocument2 pagesUnit III Sources of Capital... EpMunna MattaNo ratings yet

- Presentation - Sources - of - Finance - BST SEMINARDocument16 pagesPresentation - Sources - of - Finance - BST SEMINARManav MohantyNo ratings yet

- UN 6 FinancingDocument74 pagesUN 6 FinancingKnife KelilNo ratings yet

- Sources of Finance for BusinessesDocument14 pagesSources of Finance for Businessesnobe gamingNo ratings yet

- Sources of Finance: Internal vs ExternalDocument13 pagesSources of Finance: Internal vs ExternalMahathiNo ratings yet

- CHAPTER SIX Business FinacingDocument57 pagesCHAPTER SIX Business FinacingMeklit TenaNo ratings yet

- Esbm - 4Document32 pagesEsbm - 4Rahemat alamNo ratings yet

- Let's Know: Learning Activity SheetDocument8 pagesLet's Know: Learning Activity SheetWahidah BaraocorNo ratings yet

- Short Term & Long Term FinancesDocument22 pagesShort Term & Long Term Financesjaydee_atc5814100% (3)

- 11th Business Studies - Chapter 7 Sources of Business FinanceDocument52 pages11th Business Studies - Chapter 7 Sources of Business FinanceAnmol GrewalNo ratings yet

- 223 FinanceDocument4 pages223 FinanceNaveed ArainNo ratings yet

- JVBJKDocument14 pagesJVBJKananya020605No ratings yet

- 6.1. Financial Requirements: Chapter - Six Financing Small BusinessDocument9 pages6.1. Financial Requirements: Chapter - Six Financing Small BusinessMelody LisaNo ratings yet

- Unit 1 NotesDocument20 pagesUnit 1 NotesSagar AchNo ratings yet

- Ch8. Sources of Business Finance (AK)Document10 pagesCh8. Sources of Business Finance (AK)Arundhoti MukherjeeNo ratings yet

- Chapter 6 Business FinancingDocument16 pagesChapter 6 Business Financingtegegne abdissaNo ratings yet

- Financing Your BusinesspptDocument31 pagesFinancing Your BusinesspptShruti PaulNo ratings yet

- Chapter Six Financing Small Business: A) Permanent Capital - Equity CapitalDocument6 pagesChapter Six Financing Small Business: A) Permanent Capital - Equity CapitalROBSANNo ratings yet

- Financial Management and Securities MarketsDocument6 pagesFinancial Management and Securities MarketsKomal RahimNo ratings yet

- Unit 2: Managing Financial Resources and Decisions Submitted By: Muhammad Danyal Aziz Noor To Sir Muhammad Ehtisham Course: HND BusinessDocument45 pagesUnit 2: Managing Financial Resources and Decisions Submitted By: Muhammad Danyal Aziz Noor To Sir Muhammad Ehtisham Course: HND BusinessjojoNo ratings yet

- Business Management: FinanceDocument42 pagesBusiness Management: FinanceRamNo ratings yet

- Definition of Business FinanceDocument4 pagesDefinition of Business FinanceClovisNo ratings yet

- A Handbook On Private Equity FundingDocument109 pagesA Handbook On Private Equity FundingLakshmi811No ratings yet

- Sources of Capital: Term Structure of FundsDocument5 pagesSources of Capital: Term Structure of FundsRasheed LawalNo ratings yet

- Sources of FinanceDocument3 pagesSources of FinanceSaif TahlakNo ratings yet

- Chapter 5 Entrepreneurial FinanceDocument53 pagesChapter 5 Entrepreneurial FinancekyrastenkeNo ratings yet

- BUSINESS FINANCE SOURCES AND NEEDSDocument19 pagesBUSINESS FINANCE SOURCES AND NEEDSपशुपति नाथNo ratings yet

- Financing Your BusinessDocument31 pagesFinancing Your Businessorazdovlet001No ratings yet

- CF NotesDocument5 pagesCF Notes087-Md Arshad Danish KhanNo ratings yet

- Chapter 3 - Sources of FinancingDocument5 pagesChapter 3 - Sources of FinancingSteffany RoqueNo ratings yet

- Australian Managed Funds for Beginners: A Basic Guide for BeginnersFrom EverandAustralian Managed Funds for Beginners: A Basic Guide for BeginnersNo ratings yet

- A Warm-Up Activity: FIND SOMEONE WHO .: Prepared By: Christopher B. Cauan, LPT, MSDCDocument2 pagesA Warm-Up Activity: FIND SOMEONE WHO .: Prepared By: Christopher B. Cauan, LPT, MSDCChristopher Beltran CauanNo ratings yet

- Financial Statement Analysis: Mr. Christopher B. CauanDocument63 pagesFinancial Statement Analysis: Mr. Christopher B. CauanChristopher Beltran CauanNo ratings yet

- Chapter 3 Financial PlanningDocument25 pagesChapter 3 Financial PlanningChristopher Beltran CauanNo ratings yet

- Chapter 1. Introduction To Financial ManagementDocument42 pagesChapter 1. Introduction To Financial ManagementChristopher Beltran CauanNo ratings yet

- Chapter 1. Introduction To Financial ManagementDocument42 pagesChapter 1. Introduction To Financial ManagementChristopher Beltran CauanNo ratings yet

- BL3 MidtermDocument21 pagesBL3 MidtermSherri BonquinNo ratings yet

- G.R. No. 92585 Caltex Phils. Vs COADocument41 pagesG.R. No. 92585 Caltex Phils. Vs COAnanatanfitnessNo ratings yet

- Mariano Lerin Bookstore Chart of AccountsDocument15 pagesMariano Lerin Bookstore Chart of AccountsMaria Beatriz Aban Munda75% (4)

- Ucp 600Document12 pagesUcp 600Usman Rajput100% (1)

- Agcaoili LTD PDFDocument32 pagesAgcaoili LTD PDFruss8dikoNo ratings yet

- Bautista v. Bautista - PartitionDocument2 pagesBautista v. Bautista - PartitionFritz SaponNo ratings yet

- Merchant BankingDocument10 pagesMerchant BankingSunita KanojiyaNo ratings yet

- ALM Mismatch, IL&FS Crisis and RBIDocument2 pagesALM Mismatch, IL&FS Crisis and RBIRaghav DhootNo ratings yet

- Final Quiz College AlgebraaDocument2 pagesFinal Quiz College AlgebraalenerNo ratings yet

- Quiambao Vs China BankDocument4 pagesQuiambao Vs China BankVikki Mae AmorioNo ratings yet

- Finance ProjectDocument78 pagesFinance ProjectRuchi SharmaNo ratings yet

- BFI 1 IntroductionDocument40 pagesBFI 1 IntroductionImran MjNo ratings yet

- Personal Liability of Corporate Officers Under Trust ReceiptsDocument7 pagesPersonal Liability of Corporate Officers Under Trust ReceiptsTrem GallenteNo ratings yet

- ECON 300 Practice Quiz TwoDocument12 pagesECON 300 Practice Quiz Twosam lissenNo ratings yet

- Power of Attorney Homeloan New FormatDocument7 pagesPower of Attorney Homeloan New FormatMukesh DubeyNo ratings yet

- Discount and Finance House of India (DFHIDocument18 pagesDiscount and Finance House of India (DFHISaurabh SharmaNo ratings yet

- Dissolution of a Partnership FirmDocument46 pagesDissolution of a Partnership FirmPadmalochan NayakNo ratings yet

- Hire Purchase FULL N FINALDocument12 pagesHire Purchase FULL N FINALAmyt KadamNo ratings yet

- Evidence of Property Insurance: Perils Insured Basic Broad SpecialDocument1 pageEvidence of Property Insurance: Perils Insured Basic Broad SpecialOption 1 InsuranceNo ratings yet

- Contract AntichresisDocument3 pagesContract AntichresisFe OrdonezNo ratings yet

- Hap Seng Consolidated Berhad Ar2015Document251 pagesHap Seng Consolidated Berhad Ar2015mohdkhidirNo ratings yet

- Quijano Vs DBP, GR No. L-26419Document7 pagesQuijano Vs DBP, GR No. L-26419AddAllNo ratings yet

- Winding Up Banking Company ProcedureDocument13 pagesWinding Up Banking Company ProcedureVinay KumarNo ratings yet

- DRAFT LEASE AGREEMENT - ROOP POLYMERS 132-4 IMT - AmendedDocument9 pagesDRAFT LEASE AGREEMENT - ROOP POLYMERS 132-4 IMT - AmendedGirish SharmaNo ratings yet

- Conventional RedemptionDocument4 pagesConventional RedemptionReinaur Signey Aluning100% (2)

- Compound InterestDocument9 pagesCompound Interestdivya1587No ratings yet

- Land Titles and Deeds - Subsequent Registration - Sps Macadangdang V Sps MartinezDocument3 pagesLand Titles and Deeds - Subsequent Registration - Sps Macadangdang V Sps MartinezJosephine BrackenNo ratings yet

- Deber No. 3 - FuncioneDeber No. 3 - Funciones - PdfsDocument32 pagesDeber No. 3 - FuncioneDeber No. 3 - Funciones - Pdfsgeaguiar100% (1)

- The Significance of Sponsorship in Sport MarketingDocument52 pagesThe Significance of Sponsorship in Sport MarketingEstherTanNo ratings yet