Professional Documents

Culture Documents

Insurance

Uploaded by

Charu Arora0 ratings0% found this document useful (0 votes)

109 views15 pagesOriginal Title

insurance

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

109 views15 pagesInsurance

Uploaded by

Charu AroraCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 15

Insurance Definition

• Insurance is a contract whereby, in return for the

payment of premium by the insured, the insurers

pay the financial losses suffered by the insured

as a result of the occurrence of unforeseen

events.

Risk

• The term Risk is used to describe all the

accidental happenings which produce a

monetary loss. For e.g.: A factory catching fire, a

ship sinking etc.

Principles of Insurance

Utmost Good Faith

Insurable Interest

Indemnity

• Subrogation

• Contribution

Proximate Cause

Utmost Good Faith

Good faith- Let the buyer beware

Declaration of all material Information

about the subject mater of insurance

Material Information is that information

which enables the insurer to decide:

a) whether he will accept the risk and;

b) if so, at what rate of premium and subject to what

terms and conditions

Breach of duty of utmost good faith arises

in two ways:

• Non-disclosure of material facts- oversight,

proposer thought it’s not essential etc.

• Misrepresentation- Intentional.

Insurable Interest

• The legal right enjoyed by the owner of a

property to insure is called ‘Insurable

Interest’. The insurance will become null

and void, without the insurable interest.

Indemnity

• The principle of Indemnity states that under the policy of

insurance, the insured has to be placed after the loss in

the same financial position in which he was immediately

before the loss.

• Applicability:

o When the losses suffered by the insured can be

measured in terms of money

o It is practicable to place the insured in the same

financial position which he occupied before the

loss

• In Marine Cargo where valued polices are

issued, there is only commercial

indemnity- the value declared for

insurance is accepted at the time of loss.

Limitation of Insurers liability:

– If the sum insured is less than the indemnity,

only the sum insured is payable.

– Property insurances- Condition of average-

If there is under insurance only

proportionate value is payable.

– Excess/Franchise

Exceptions for Indemnity: Personal Accident

Subrogation

• Transfer of rights and remedies from the insured

to the insurer who has indemnified the insured in

respect of the loss.

Contribution

• The right of insurers who have paid a loss under

a policy to recover a proportionate amount from

other insurers, who are liable for the same loss.

Proximate Cause

• The active efficient

cause that sets in

motion a train of events

which brings about a

result without

intervention of any force

started and working

actively from a new

independent source.

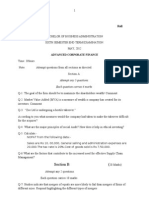

Case:

A man travelling in a crowded train falls down and

gets injured badly. Because of his hurt and

bleeding he becomes unconscious and lying by

the side of the track. Someone finds him takes

him home. He develops fever which ultimately

leads to Tetanus and is hospitalised. He is

treated in the hospital for ten days then finally he

dies! His wife realising he has a personal

accident policy makes a claim with the insurance

company. Is this claim payable?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Chapetr 1 201810151545Document14 pagesChapetr 1 201810151545Charu AroraNo ratings yet

- Cost ConceptsDocument35 pagesCost ConceptsDhruv KaushikNo ratings yet

- Reading GT Practice2Document15 pagesReading GT Practice2alamir2020100% (1)

- Reading GT Practice2Document15 pagesReading GT Practice2alamir2020100% (1)

- Balanced Score CardDocument26 pagesBalanced Score CardCharu Arora100% (1)

- Risk and ReturnDocument9 pagesRisk and ReturnCharu AroraNo ratings yet

- B00ys17cfs EbokDocument23 pagesB00ys17cfs EbokCharu AroraNo ratings yet

- What Is Banking?: Amity Global Business SchoolDocument9 pagesWhat Is Banking?: Amity Global Business SchoolCharu AroraNo ratings yet

- Reading GT Practice1 PDFDocument16 pagesReading GT Practice1 PDFVasy ObrejaNo ratings yet

- Basic Principles: Amity Global Business SchoolDocument32 pagesBasic Principles: Amity Global Business SchoolCharu AroraNo ratings yet

- Corporate RestructuringDocument41 pagesCorporate RestructuringCharu AroraNo ratings yet

- Factoring Services ConceptDocument39 pagesFactoring Services ConceptCharu AroraNo ratings yet

- Roll No .: Section B (Document4 pagesRoll No .: Section B (Charu AroraNo ratings yet

- Statement of Changes in Financial Position: Cash Flow StatementDocument25 pagesStatement of Changes in Financial Position: Cash Flow StatementCharu Arora100% (1)

- Performance Measurement.Document24 pagesPerformance Measurement.Charu AroraNo ratings yet

- Agency ProblemDocument31 pagesAgency ProblemCharu AroraNo ratings yet

- ING Wholesale Banking: Standard PresentationDocument32 pagesING Wholesale Banking: Standard PresentationCharu AroraNo ratings yet

- Balance Score CardDocument26 pagesBalance Score CardAanandbossNo ratings yet

- Strategy For Tourism: Unit 6Document36 pagesStrategy For Tourism: Unit 6mainasaNo ratings yet

- Lecture 6Document31 pagesLecture 6Charu AroraNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IC 92 Multiple Question BankDocument54 pagesIC 92 Multiple Question BankTRANSFORMERLOGICS90% (10)

- Tanny Cabrera Company Cash BudgetDocument5 pagesTanny Cabrera Company Cash BudgetLysss EpssssNo ratings yet

- Acc Project 2023-24 - For Students Accounting Ratio and Commparative & CommonsizeDocument18 pagesAcc Project 2023-24 - For Students Accounting Ratio and Commparative & Commonsizelegendyt949No ratings yet

- Stock and Bonds - ActivityDocument11 pagesStock and Bonds - Activitysab x btsNo ratings yet

- Colin - BookDocument15 pagesColin - BookrizwanNo ratings yet

- Personal Finance - Introduction Ver 0.4Document59 pagesPersonal Finance - Introduction Ver 0.4Aravind MenonNo ratings yet

- Statements 2862Document4 pagesStatements 2862Jeffery Haack75% (4)

- HardikDocument47 pagesHardikAngelito Geronimo75% (8)

- SUBEXLTD 20062022131358 QuickResultsDocument23 pagesSUBEXLTD 20062022131358 QuickResultsSocial OnlyNo ratings yet

- Resumos - APFDocument23 pagesResumos - APFMariana GomesNo ratings yet

- Department of Financial Institutions ESBMDocument34 pagesDepartment of Financial Institutions ESBMAnu VanuNo ratings yet

- How Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaDocument17 pagesHow Brookfield and Peers Make Money and How You Can Participate in 2023 (NYSE - BAM) - Seeking AlphaMeester KewpieNo ratings yet

- Lecture 5Document28 pagesLecture 5Dalia SamirNo ratings yet

- Margarita S. Monilla - Resume PDFDocument2 pagesMargarita S. Monilla - Resume PDFFBG- KinNo ratings yet

- MERS Info - Discovery - Submissions - InterrogatoriesDocument15 pagesMERS Info - Discovery - Submissions - InterrogatoriesForeclosure Fraud67% (3)

- Bank ReconciliationDocument20 pagesBank ReconciliationJalieca Lumbria GadongNo ratings yet

- FDC Tax InvoiceDocument12 pagesFDC Tax InvoiceAnura PiyatissaNo ratings yet

- VILLALVA V RCBC BankDocument1 pageVILLALVA V RCBC BankNino Kim AyubanNo ratings yet

- Oct+31,+2022 2Document7 pagesOct+31,+2022 2nyNo ratings yet

- EDF PresentationDocument15 pagesEDF PresentationMohammad Mehedi Al-SumanNo ratings yet

- Aea HIVEpv TOjad WDocument14 pagesAea HIVEpv TOjad WAadarshNo ratings yet

- Accounting 121Document2 pagesAccounting 121Now OnwooNo ratings yet

- Audit ReviewerDocument32 pagesAudit ReviewerDianna Rose VicoNo ratings yet

- Rashid Riaz: A Proficient Account and Finance ProfessionalDocument1 pageRashid Riaz: A Proficient Account and Finance ProfessionalRashid RiazNo ratings yet

- PNB Liable for Payment of Forged ChecksDocument10 pagesPNB Liable for Payment of Forged ChecksRene ValentosNo ratings yet

- Differentiate Between Specific Borrowings and General Borrowings. Give Examples. Specific BorrowingsDocument2 pagesDifferentiate Between Specific Borrowings and General Borrowings. Give Examples. Specific BorrowingsAwesome SomeoneNo ratings yet

- Warranties Liabilities Patents Bids and InsuranceDocument39 pagesWarranties Liabilities Patents Bids and InsuranceVanvan Biton100% (1)

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsArik HassanNo ratings yet

- (02D) Demonstration Trial BalanceDocument22 pages(02D) Demonstration Trial BalanceGabriella JNo ratings yet

- Internship Report of Nepal Bank Limited OveralllDocument7 pagesInternship Report of Nepal Bank Limited OverallldingautamNo ratings yet