Professional Documents

Culture Documents

Variance Analysis: Prof. Guru Prasad Faculty Member Inc Guntur

Uploaded by

PUTTU GURU PRASAD SENGUNTHA MUDALIAROriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Variance Analysis: Prof. Guru Prasad Faculty Member Inc Guntur

Uploaded by

PUTTU GURU PRASAD SENGUNTHA MUDALIARCopyright:

Available Formats

Variance analysis

Prof. GURU PRASAD

FACULTY MEMBER

INC GUNTUR

pgp4149@gmail.com

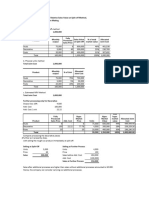

Budget for January

Particulars Product A Product B Product C Total Budget

100 100 100

Unit Total Unit Total Unit Total

Sales 1.00 100.00 2.00 200.00 3.00 300.00 600.00

Standard Variable cost:

Material 0.50 50.00 0.70 70.00 1.50 150.00 270.00

Labor 0.10 10.00 0.15 15.00 0.10 10.00 35.00

Variable Overheads 0.20 20.00 0.25 25.00 0.20 20.00 65.00

Total Variable Cost 0.80 80.00 1.10 110.00 1.80 180.00 370.00

Contribution 0.20 20.00 0.90 90.00 1.20 120.00 230.00

Fixed Costs:

Fixed Overheads 25.00 25.00 25.00 75.00

Selling Expenses 17.00 17.00 17.00 51.00

Administrative Overheads 8.00 8.00 8.00 24.00

Total Fixed Costs 50.00 50.00 150.00

Profit Before Tax -30.00 40.00 70.00 80.00

Selling Price Variance

A B C Total

Actual Volume 100.00 200.00 150.00

Actual Price Per unit 0.90 2.05 2.50

Budgeted Price Per Unit 1.00 2.00 3.00

Actual over/(under) budget price (0.1) 0.05 (0.5)

Actual Over/under Budget per unit -0.10 10.00 -75.00 -75.00

Sales Mix and Volume Variance

Product Actual Volume Budgeted Volume Difference Unit Variance

Contribution

A 100 100 - - 0

B 200 100 100 0.90 90

C 150 100 50 1.20 60

Total 450 300 150

Mix Variance

Product Budgeted Budgeted mix at Actual Difference Unit Variance

Proportion actual volume Sales Contribution

A

0.33 150.00 100.00 (50.00) 0.20 -10.0

0

B

0.33 150.00 200.00 50.00 0.90 45.00

C

0.33 150.00 150.00

Total 450.00 450.00 35.00

Sales Volume Variance

Product Budgeted Budgeted Difference Unit Volume

Mix at Volume Contribution Variance

Actual

Volume

A 150 100 50 0.20 10

B 150 100 50 0.90 45

C 150 100 50 1.20 60

Total 450 300 150 115

Revenue Variances by Product

A B C Total

Price Variance (10) 10 (75) (75)

Mix Variance (10) 45 - 35

Volume Variance 10 45 60 115

Total (10) 100 (15) 75

Industry Volume and Market share Variances

A. Budgeted Sales Volume

Product A Product B Product C Total

Estimated Industry Volume (Units) 833 500 1667 3000

Budgeted Market Share 12% 20% 6% 10%

Budgeted Volume (Units) 100 100 100 300

B. Actual Market Share

Product A Product B Product C Total

Actual Industry Volume 1000 1000 1000 3000

Actual Sales (units) 100 200 150 450

Actual Market Share 10% 20% 15% 15%

C. Variance Due to Market Share

Product A Product B Product C Total

(1) Actual Sales( Units) 100 200 150 450

(2) Budgeted Shares at actual Industry Volume 120 200 60 380

(3) Difference(1-2) -20 - 90 70

(4) Budgeted Unit Contribution 0.2 0.9 1.2

(5) Variance Due to market share(3*4) (4.00) - 108 104

D. Variance Due to Industry Volume

Product A Product B Product C Total

(1) Actual Industry Volume 1000 1000 1000 3000

(2) Budgeted Industry Volume 833 500 1667 3000

(3) Difference(1-2) 167 500 667 0

(4) Budgeted Market share 12 20 6

(5)( 3*4) 20 100 (40.00)

(6) Unit Contribution budget) 0.20 0.90 1.20

Fixed cost Variances

Actual Budget Favorable or

Unfavorable

Fixed 75 75 -

Overhead

Selling 55 50 (5)

Expenses

Administrative 30 25 (5)

Expenses

Total 160 150 (10)

Variations In Practice

• Time Period of the comparison

• Focus on Gross Margin

• Evaluation Standards

Historical Standards

External Standards

• Limitations of Standards

• Full Cost System

• Amount of Detailed

• Engineered Discretionary costs

Limitations of Variance Analysis

• It tells ‘where’ the variance occurred but

not ‘why’

• Significance of variance is not determined

• Information may be misinterpreted if the

data is aggregated

• Future effects of variances not known

Variable Manufacturing Expenses Variances

A B C Total Actual Favorable /

Unfavorable

Material 75 84 300 459 470 (11)

Labor 15 18 20 53 65 (12)

Overhead 30 30 40 100 90 10

(variable)

120 132 360 612 625 (13)

Summary Performance Report

Actual Profit 132

Budgeted Profit 80

Variance 52

Analysis of Variance-Favorable/Unfavorable

Revenue Variances:

Price (75)

Mix Variance 35

Volume 115

Net Revenue Variance 75

Variable Cost Variances:

Material (11)

Labor (12)

Variable Overhead 10

Net variable cost variance (13)

Fixed Cost Variances:

Selling Expenses (5)

Administrative Expenses (5)

Net fixed cost variances (10)

Variance (52)

You might also like

- Variance Analysis: Presented By: Gurleen Kaur MBA (3 Sem)Document18 pagesVariance Analysis: Presented By: Gurleen Kaur MBA (3 Sem)Supriya OhriNo ratings yet

- IRR Financial ModelDocument110 pagesIRR Financial ModelericNo ratings yet

- 2008 Purchase Request FormDocument1 page2008 Purchase Request Formcolorado576No ratings yet

- Role of Customer Delight - IpsosDocument12 pagesRole of Customer Delight - IpsosSugandha TanejaNo ratings yet

- Costing and Budgeting by YousufDocument23 pagesCosting and Budgeting by YousufYousuf HasanNo ratings yet

- Startup QuestionsDocument8 pagesStartup Questionsrt raoNo ratings yet

- A) Direct Material Variances: Sub Usage Variance Mix VarianceDocument3 pagesA) Direct Material Variances: Sub Usage Variance Mix Variancekamalesh123No ratings yet

- MCS Case StudyDocument17 pagesMCS Case StudyPratik Tambe0% (1)

- Budgeting Case StudyDocument1 pageBudgeting Case Studykisschotu100% (1)

- Certified Valuation Analyst-CVADocument4 pagesCertified Valuation Analyst-CVAamyhashemNo ratings yet

- COST CONTROL: STANDARD COSTING & VARIANCE ANALYSISDocument36 pagesCOST CONTROL: STANDARD COSTING & VARIANCE ANALYSISParesh JhaNo ratings yet

- Performance Toolkit V2Document16 pagesPerformance Toolkit V2BobbyNicholsNo ratings yet

- Customer Profitability Analysis1Document2 pagesCustomer Profitability Analysis1titanunleashedNo ratings yet

- Financial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMDocument35 pagesFinancial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMahmad syaifudinNo ratings yet

- Equity Research QsDocument12 pagesEquity Research QsIpsita PatraNo ratings yet

- Valuation Concepts and Issues (IASB 2007)Document70 pagesValuation Concepts and Issues (IASB 2007)So LokNo ratings yet

- Revenue Variance ExampleDocument1 pageRevenue Variance ExampleImperoCo LLCNo ratings yet

- Marketing Strategies at Maturity Stage of PLCDocument14 pagesMarketing Strategies at Maturity Stage of PLCanon_177231796No ratings yet

- Business CycleDocument13 pagesBusiness CycleAanchal SetiaNo ratings yet

- TVM Chapter SummaryDocument43 pagesTVM Chapter SummaryVan Tu ToNo ratings yet

- Eagle Asset Management PDFDocument67 pagesEagle Asset Management PDFYizhenNo ratings yet

- Equity Vs EVDocument9 pagesEquity Vs EVSudipta ChatterjeeNo ratings yet

- HRM 11 CompensationDocument24 pagesHRM 11 CompensationFaizan KhanNo ratings yet

- Budget Summary Report: (Company Name)Document6 pagesBudget Summary Report: (Company Name)chatree pokaew100% (1)

- Business Combinations - PPADocument83 pagesBusiness Combinations - PPAAna SerbanNo ratings yet

- Steps in Strategy Formulation ProcessDocument13 pagesSteps in Strategy Formulation ProcessЛілія ВисіцькаNo ratings yet

- Are You Sure You Have A StrategyDocument27 pagesAre You Sure You Have A Strategytushar0909No ratings yet

- Fin512 习题1Document21 pagesFin512 习题1Biao Wang100% (1)

- Account Opening. For CustomersDocument3 pagesAccount Opening. For CustomersBilal SiddiquiNo ratings yet

- Important BPM Model NotesDocument66 pagesImportant BPM Model Noteskunjan2165No ratings yet

- ABSORPTION COSTING PRINCIPLESDocument22 pagesABSORPTION COSTING PRINCIPLESKamauWafulaWanyamaNo ratings yet

- Lecture8-Intro To Digital MarketingDocument48 pagesLecture8-Intro To Digital MarketingUsman AnwarNo ratings yet

- Blue Star Limited: Investor PresentationDocument32 pagesBlue Star Limited: Investor PresentationSunny GanpuleNo ratings yet

- Budget vs Actual Sales AnalysisDocument2 pagesBudget vs Actual Sales Analysisintan kartikaNo ratings yet

- LatihanDocument1 pageLatihanviviismaniaNo ratings yet

- Management Control System: Assignment IIDocument6 pagesManagement Control System: Assignment IIYogesh AbhaniNo ratings yet

- IA Chapter-11-14Document7 pagesIA Chapter-11-14Christine Joyce EnriquezNo ratings yet

- Case 10-1 Rina YeniDocument6 pagesCase 10-1 Rina Yenivonny corneliaNo ratings yet

- Case 10-1 - Group 3 - ZDocument19 pagesCase 10-1 - Group 3 - Zvonny corneliaNo ratings yet

- Case Study Analysis of Product Mix ChangesDocument8 pagesCase Study Analysis of Product Mix ChangesMurat Kalender100% (1)

- Costing CaseDocument6 pagesCosting CasenguyenthingocmaimkNo ratings yet

- SAPMDocument7 pagesSAPMrakeshkakaniNo ratings yet

- Material Budget (RS.)Document6 pagesMaterial Budget (RS.)James WisleyNo ratings yet

- Joint Product & By-Product ExamplesDocument15 pagesJoint Product & By-Product ExamplesMuhammad azeemNo ratings yet

- Tutorial 4 AnswersDocument5 pagesTutorial 4 AnswersJohn TomNo ratings yet

- Forecast-output-costDocument9 pagesForecast-output-costCrisfred Kyle PereiraNo ratings yet

- Bill French, AccountantDocument3 pagesBill French, AccountantAshutosh RanjanNo ratings yet

- May TechDocument6 pagesMay TechMonica LlenaresasNo ratings yet

- BudgetDocument16 pagesBudgetrikesh radheNo ratings yet

- UnitronDocument9 pagesUnitronIvan Naufal PriadyNo ratings yet

- Case 20 3Document3 pagesCase 20 3Елена КорховаNo ratings yet

- Product Mix - 50% For Large and 50% For MediumDocument2 pagesProduct Mix - 50% For Large and 50% For Mediumemem buezaNo ratings yet

- UnitRon Case SolutionDocument5 pagesUnitRon Case SolutionsaNo ratings yet

- Joint Product & By-ProductDocument14 pagesJoint Product & By-ProductMuhammad azeem100% (1)

- Problem 7-34 AbxcjasidhDocument1 pageProblem 7-34 AbxcjasidhrpztxNo ratings yet

- CVP Relevant CostDocument15 pagesCVP Relevant CostSoumya Ranjan PandaNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- Economics of CostDocument68 pagesEconomics of CostMichaelAngeloBattungNo ratings yet

- PVC & BE AnalysisDocument8 pagesPVC & BE Analysismc limNo ratings yet

- Cost-Volume-Profit Relationships1Document52 pagesCost-Volume-Profit Relationships1Kamrul Huda100% (1)

- International Business Class 11 CBSEDocument126 pagesInternational Business Class 11 CBSEPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- MANGLORE To GOA 3Document53 pagesMANGLORE To GOA 3PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Small Business 2 MSME ACT 2020Document56 pagesSmall Business 2 MSME ACT 2020PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Mixed Mcqs From CH 8 ControllingDocument17 pagesMixed Mcqs From CH 8 ControllingPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Mixed Mcqs From CH 5 OrganisingDocument24 pagesMixed Mcqs From CH 5 OrganisingPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Trade CreditDocument5 pagesTrade CreditPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Lease 5Document16 pagesLease 5PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Code of and Ethics: ConductDocument53 pagesCode of and Ethics: ConductHR SagarsoftNo ratings yet

- Factoring Service 2Document15 pagesFactoring Service 2PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Retained Earnings 3Document12 pagesRetained Earnings 3PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Aphorism 1Document21 pagesAphorism 1PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Mixed Mcqs From CH 7 DirectingDocument25 pagesMixed Mcqs From CH 7 DirectingPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- CSR P1 CH 6Document102 pagesCSR P1 CH 6PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Mixed Mcqs From CH 3 Business EnvironmentDocument17 pagesMixed Mcqs From CH 3 Business EnvironmentPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Mixed Mcqs From CH 6 StaffingDocument36 pagesMixed Mcqs From CH 6 StaffingPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Modes of BusinessDocument48 pagesModes of BusinessPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Mixed Mcqs From CH 4 PlanningDocument18 pagesMixed Mcqs From CH 4 PlanningPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Business Ethics CH 6Document18 pagesBusiness Ethics CH 6PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Benefits of E-CommerceDocument22 pagesBenefits of E-CommercePUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Business Ethics CH 6Document18 pagesBusiness Ethics CH 6PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- CSR P1 CH 6Document102 pagesCSR P1 CH 6PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Business Ethics CH 6Document18 pagesBusiness Ethics CH 6PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Mixed MCQs From CH 5 XiDocument70 pagesMixed MCQs From CH 5 XiPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Case Study On Mass Production - Emerging Modes of BusinessDocument17 pagesCase Study On Mass Production - Emerging Modes of BusinessPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Emerging Modes of Business VIVA BS XIDocument104 pagesEmerging Modes of Business VIVA BS XIPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Class 12 Business Studies Chapter 12 MCQ'sDocument41 pagesClass 12 Business Studies Chapter 12 MCQ'sPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- OutsourcingDocument42 pagesOutsourcingPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Emerging Modes of Business VIVA BS XIDocument104 pagesEmerging Modes of Business VIVA BS XIPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- MCQs in MarketingDocument51 pagesMCQs in MarketingPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Modes of BusinessDocument48 pagesModes of BusinessPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Discussion 2 Cost Concepts Terminologies and Behaviors 1Document7 pagesDiscussion 2 Cost Concepts Terminologies and Behaviors 1RHEGIE WAYNE PITOGONo ratings yet

- Remedial 2Document6 pagesRemedial 2Jelwin Enchong BautistaNo ratings yet

- UNIT-2 Notes B.Arch HousingDocument104 pagesUNIT-2 Notes B.Arch HousingHasiba Barisa50% (2)

- Review of Cost Acctg 1Document9 pagesReview of Cost Acctg 1Shane TorrieNo ratings yet

- Sap SapDocument313 pagesSap SapVenu Undavilli75% (4)

- Possitive Accounting TeoriDocument20 pagesPossitive Accounting TeorigkrNo ratings yet

- In-Class Exercises and Discussion QuestionsDocument8 pagesIn-Class Exercises and Discussion QuestionsNguyễn Thị Thanh ThúyNo ratings yet

- Unit 4 - Accounting For Labour CostDocument18 pagesUnit 4 - Accounting For Labour CostAayushi KothariNo ratings yet

- Dental Juris and Practice MGT Board 2008Document14 pagesDental Juris and Practice MGT Board 2008Anonymous FwwfR650% (2)

- Problem Unit 4Document7 pagesProblem Unit 4meenasaratha100% (1)

- Philippine Review Institute for Accountancy (PRIA) Cost Accounting NotesDocument7 pagesPhilippine Review Institute for Accountancy (PRIA) Cost Accounting NotesPau SantosNo ratings yet

- Chapter 2aDocument38 pagesChapter 2aShannon BánañasNo ratings yet

- Chapter 18-Spoilage, Rework andDocument2 pagesChapter 18-Spoilage, Rework andZeinab MohamadNo ratings yet

- Texas Fiscal 2023Document82 pagesTexas Fiscal 2023jnewmanNo ratings yet

- ABC Practice Problems Answer KeyDocument10 pagesABC Practice Problems Answer KeyKemberly AribanNo ratings yet

- Management AccountingDocument223 pagesManagement Accountingcyrus100% (2)

- AccountingDocument34 pagesAccountingAfia ZaheenNo ratings yet

- Agamata Relevant Costing Chap 9 Short Term DecisionpdfDocument66 pagesAgamata Relevant Costing Chap 9 Short Term DecisionpdfJerome Eziekel Posada PanaliganNo ratings yet

- ACC20020 Management - Accounting Exam - 22-23Document12 pagesACC20020 Management - Accounting Exam - 22-23Anonymous qRU8qVNo ratings yet

- CH 8Document64 pagesCH 8Chang Chan ChongNo ratings yet

- Accounting For Manufacturing OperationsDocument49 pagesAccounting For Manufacturing Operationsgab mNo ratings yet

- Angel Soap Industry ReportDocument94 pagesAngel Soap Industry ReportSakina MakdaNo ratings yet

- Major Quiz #2Document10 pagesMajor Quiz #2jsus22No ratings yet

- Akshita MohanDocument10 pagesAkshita Mohanakshita akshitaNo ratings yet

- Audit of Property, Plant and EquipmentDocument7 pagesAudit of Property, Plant and EquipmentclintonNo ratings yet

- Study Guide Variable Versus Absorption CostingDocument9 pagesStudy Guide Variable Versus Absorption CostingFlorie May HizoNo ratings yet

- Chapter 8-Absorption and Variable Costing, and Inventory ManagementDocument20 pagesChapter 8-Absorption and Variable Costing, and Inventory ManagementRodNo ratings yet

- Indian Accounting StandardsDocument4 pagesIndian Accounting StandardsManjunatha B KumarappaNo ratings yet

- Managerial Accounting Concepts and Principles: QuestionsDocument51 pagesManagerial Accounting Concepts and Principles: QuestionsashibhallauNo ratings yet

- Property, Plant and Equipment: Problem 28-1 (AICPA Adapted)Document21 pagesProperty, Plant and Equipment: Problem 28-1 (AICPA Adapted)Jay-B Angelo67% (3)